Bank of America (BoA) has appointed industry veteran Hari Gopalkrishnan as its new group Chief Technology and Information Officer.

Gopalkrishnan started his career as a systems analyst at Eli Lilly, following graduate and post-graduate studies in electrical engineering in Michigan.

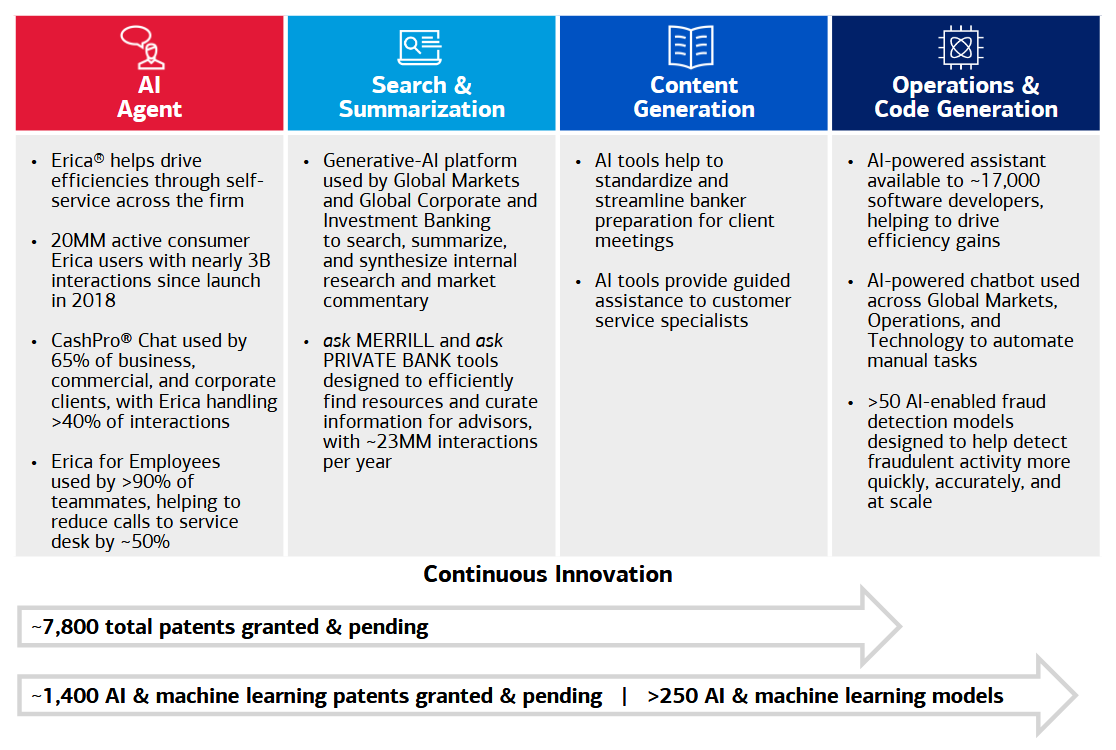

He has worked as a managing director at Lehman Brothers, Citi, and for the past 14 years at BoA, which he joined as a contractor – and where he has helped lead development of its widely deployed Erica AI chatbot.

(He was CIO for global data, operations and shared services at Citigroup, and earlier served as chief technology architect for Lehman Brothers.)

Gopalkrishnan has already had a significant technology leadership role at BoA, effectively being CIO for six of the bank’s eight lines of business.

See also: The Big Interview with Nomura's Global CTO Dinesh Keswani

Outgoing BoA CDIO Aditya Bhasin posted: “I’ve worked closely with Hari for many years, and I know firsthand his deep understanding of our business and his unwavering commitment to our clients, communities, and teammates. He’s a phenomenal leader, and I can’t wait to see all the amazing things you’ll continue to achieve under his guidance.”

In a CIO interview earlier this year Gopalkrishnan talked up the benefits of the bank’s extensive private cloud environment and homegrown AI systems – Bank of America spends some $13 billion on tech each year.

“We have been very effective at scaling [our private cloud] which lets us get to a point where we’re not paying for bursty volumes,” Gopalkrishnan told CIO.com in April – adding that it has been “interesting” to see the repatriation efforts of some organisations away from cloud computing.

“We’ve always said we’re not going to over-index and over-swing the pendulum. Our view is we essentially have a hosting strategy. We’ve got multiple availability zones in our virtual private cloud. We extensively use our virtual private cloud, and as need be, we can burst into public clouds based on the use cases, either for other software providers or for ourselves,” BoA’s new CTIO told the publication in the April interview.

BoA CEO Brian Moynihan, speaking on a July 16 Q2 call, said: “We are continuing to see the benefits of our long-term investment in technology, capabilities, digitization, machine learning, now we are starting to see at the beginnings at the AI practices that we develop pay off” – adding that in Q2 alone the bank saw four billion consumer logins to its platforms.

Moynihan added last month: “We have 17,000 programmers using AI coding technology today saving 10% to 15% in code generation costs and we expect that to continue to rise. Overall, we have 1,400 AI patents and have created over 250 AI and learning models in the company. We are currently working through many dozens of our AI proof of concepts…”

“We are moving more money into the AI side and machine learning side… It is key to note we have fully absorbed the cost of the last several years of over-inflation and wages and other third-party provided services.

“[To make clear] how much of an impact technology’s had, 15 years ago the company had a headcount of 300,000. Today, 212,000. We did that with a relentless application of scalable, secure, resilient technologies.”