Few analysts on HPE’s earnings call this week drew attention to it in an AI-focused Q&A, but the company’s GreenLake hybrid cloud proposition is quietly booming – with 42,000 customers driving a $2.2 billion run rate.

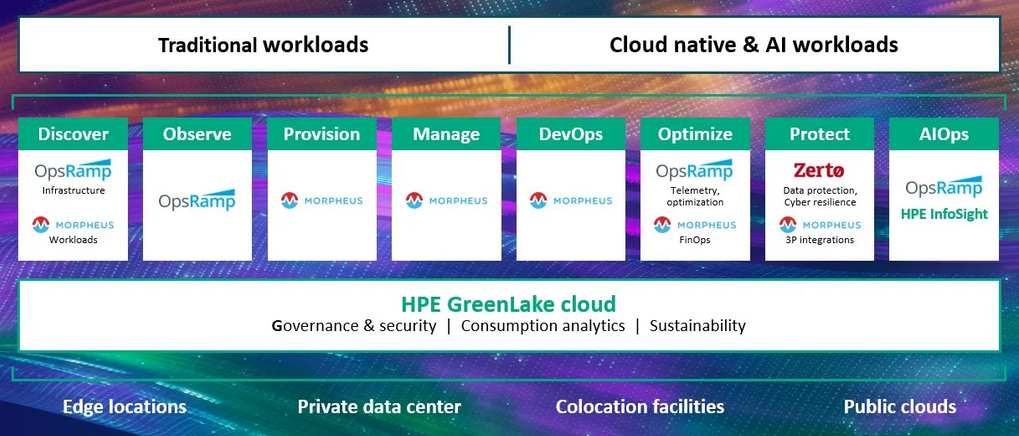

That’s a figure that’s up a striking 47% year-over-year, HPE announced on a Q2 earnings call on June 4 – weeks after adding to GreenLake with a series of services that build on its late 2024 acquisition of Morpheus Data.

These included the GA release of an “open virtualisation” suite, “Morpheus VM Essentials” that lets users manage KVM and VMware VMs from one interface and re-platform to the HPE VME hypervisor.

See also: Warren Buffett’s GEICO repatriates work from the cloud, continues ambitious infrastructure overhaul

HPE aims to peel customers away from VMware with the proposition and CEO Antonio Neri told analysts that “the virtualization part of the private cloud is very, very strong… there are now 1,000 customers logged in our pipeline [and] going through POCs.” (One customer, Danfoss, has committed to transition 75% of its virtual estate with VM Essentials within HPE GreenLake for private cloud enterprise, HPE executives claimed.)

(More broadly, GreenLake is essentially a managed private cloud that lets users self-service the deployment of bare metal, VM, and containers.)

Speaking on the earnings call HPE’s CEO Antonio Neri noted: “Software and services continue to be more than 70% of our ARR, demonstrating our portfolio shift to higher growth and higher-margin areas of the stack.”

Neri’s aggressive turnaround efforts continue at the company, which now has the lowest headcount at 59,000 it has ever seen. Neri added: “We are reducing management layers and flattening our organization because flatter is faster, enabling swifter decision-making and improving agility…

“A multi-hypervisor environment”

GreenLake’s growth comes as AI and containerisation among other trends continue to reshape infrastructure. Dell also noted the shift this week.

Speaking at the Bank of America global technology conference, Dell’s Arthur Lewis, president of its Infrastructure Solutions Group (ISG) flagged that “there's been a significant trend over the last couple of years back to disaggregated infrastructure and you start thinking about, well, why is the world moving back to disaggregated infrastructure? And the reason basically comes down to the fact that more and more customers are moving into what we refer to as a multi-hypervisor environment…”

“Why are customers doing that? They're doing that, number one, because they want to prevent venture lock-in, right? And so they want to have flexibility in terms of the cloud operating system that they use. More practically, though, they're also looking at the new workloads that are coming online, some of it due to AI that are more container and bare metal based… but also, there's been an industry shift over the last two years away from perpetual licensing and to subscription-based pricing.

“That subscription-based pricing is based on CPU cores. So in a traditional HCI, your cluster might run at 30% to 40% CPU utilization That's completely ineffective in a situation where you're paying per core. So you need the ability to scale compute and storage independently. More and more customers are now pushing back towards disaggregated…”