CDO

"The bank tracks generative AI ROI through three lenses..."

Ranil Boteju, Group Chief Data and Analytics Officer (CDAO) at Lloyds Banking Group, briefly refers to “the new thing” when talking to The Stack about the banking group’s AI deployments – a necessary clarification as the bank has been using machine learning and AI for over a decade.

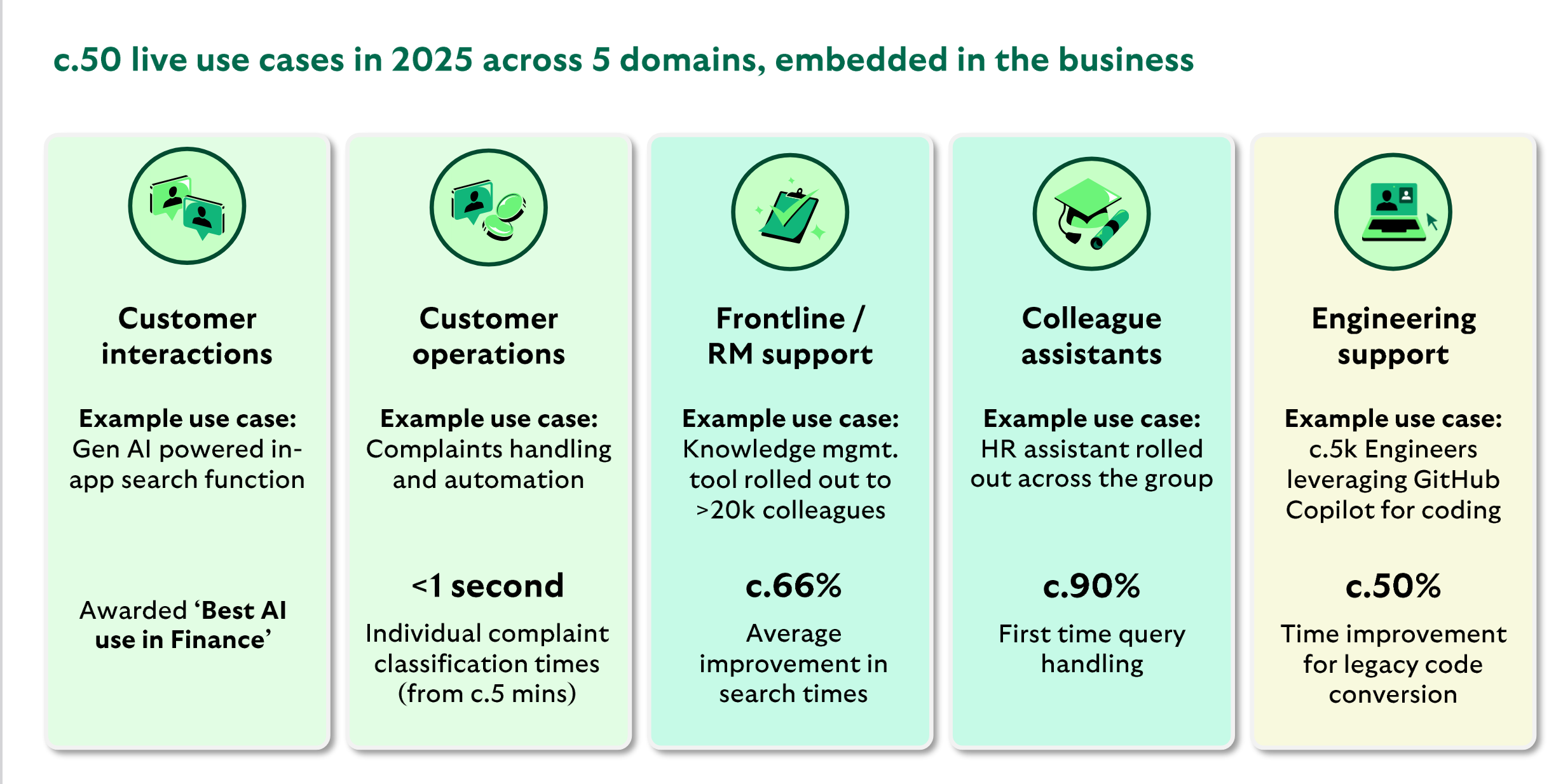

That made it quick, by a bank’s standards, to adopt the “new thing” too, he suggests: several months after ChatGPT came out, colleagues at Lloyds had already begun using generative AI to solve problems “right off the bat,” Boteju says; he quickly realized the bank needed a structured approach to testing and using the technology – it now has 50 live deployments.

Despite significant progress including on ROI, Lloyds CDAO is quick to confirm that “when it comes to more quantitative things, traditional models, data science, machine learning have worked a lot better. So, you know, we're not using [generative AI] to actually make decisions…"

Boteju, who leads AI innovation at Lloyds Banking after nearly a decade at HSBC, is no stranger to data science and “heavy duty analytics,” but says he had to upskill in LLMs and foundational models in 2022 with the rest of the world. Since then the bank has developed a bank-wide AI workbench and “control tower” to scale AI use cases across its multiple business groups.

(Since our interview, Boteju announced plans to return to Australia to join the Commonwealth Bank in January 2026 as its Chief AI Officer. Here, he reflects on his efforts at the UK's Lloyds Banking Group.)

Join peers managing over $100 billion in annual IT spend and subscribe to unlock full access to The Stack’s analysis and events.

Already a member? Sign in