Oracle’s executives spent much of Wednesday’s earnings call justifying their debt-fuelled data centre expansion – which has worried many analysts.

Co-CEO Clay Magouyrk told analysts on a Q2 call: “We don't actually incur any expenses for these large data centers until they're actually operational.”

Investors weren’t convinced – Oracle’s shares fell 10% in premarket trading after it increased its 2026 CapEx outlook by $15 billion to $50 billion.

Whilst cloud hyperscalers’ extraordinary spending on data centre hardware has been largely powered by their own cash, Oracle has turned to debt to keep up with what it says is robust industry demand for AI compute.

(Oracle’s free cash flow reached a negative $10 billion for the quarter. The company has about $106 billion in debt, according to Bloomberg.)

(Morgan Stanley Research estimates that AI Infrastructure CapEx will hit $2.9 trillion between 2025-2028, with some $1.5 trillion of that expected to be met by external capital, including $800 billion from private credit.)

Magouyrk added: “We have some other interesting models that we've been working on [where] customers can actually bring their own chips.”

“In those models, Oracle obviously doesn't have to incur any capital expenditures upfront… some [GPU] vendors are actually very interested in a model where they rent their capacity rather than selling their capacity. And as you can imagine, that comes with different cash flow impacts that are favorable reduce the overall borrowing needs and capital required.”

Oracle can “quickly convert cash spent”

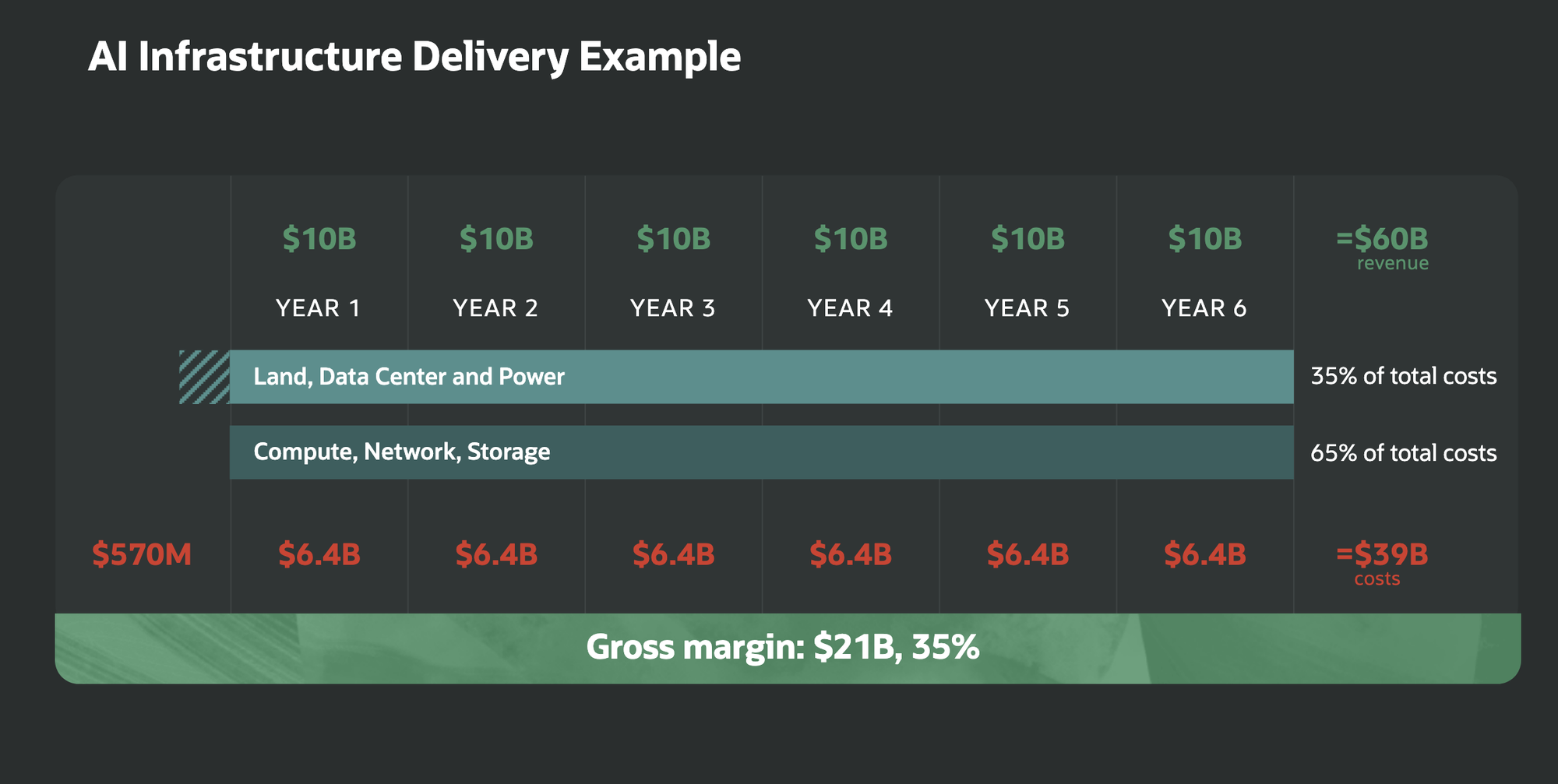

Oracle’s “Principle Financial Officer” Doug Kehring told analysts late Wednesday that “the vast majority of our CapEx investments are for revenue-generating equipment that is going into our data centers. And not for land, buildings, or power that collectively are covered via leases.

He added: “Oracle does not pay for these leases until the completed data centers and accompanying utilities are delivered to us. Rather, the equipment CapEx is purchased very late in the data center production cycle, allowing us to quickly convert cash spent into revenues earned as we provision cloud services to our contracted and committed customers.”

Oracle may tap “public bond, bank, and private debt markets” he added.

The company’s finance chief also pointed to “other financing options through customers that may bring their own chips to be installed in our data centers and suppliers who may lease their chips rather than sell them.

“Both of these options enable Oracle to synchronize our payments with our receipts and borrow substantially less than most people are modeling.”

Larry Ellison: AI on private data ftw

Oracle CTO Larry Ellison hyped the AI opportunity when it comes to enterprise data: “Training AI models on public data is the largest, fastest-growing business in history,” he said, adding: “AI models reasoning on private data will be an even larger and more valuable business.

“Oracle databases contain most of the world's high-value private data…”

Oracle said it ended the quarter with a whopping $523.3 billion in remaining performance obligations (RPO, or, crudely, contracted future revenue), up 433% from last year and up $68 billion since August.

Actual quarterly revenues were $16.1 billion, up 13% year-on-year.