Trenchant AI critic Professor Gary Marcus has vowed to short-sell OpenAI if it goes public – claiming it is unreliable and has “no technical moat.”

Marcus, a professor emeritus at New York University, and the founder of two AI startups, said on Sunday that he will put his money where his mouth is when it comes to his regular criticism of the newly for-profit company.

He’ll have to wait…

OpenAI is reported by Reuters to be mulling a potential IPO in late 2026.

The newswire says OpenAI ARR is expected to hit “about $20 billion by year-end” but that “losses are also mounting inside the $500 billion company.”

The rate of OpenAI’s losses is not public. But (a problematically opaque) Microsoft revealed it booked $4.1 billion in pre-tax losses from OpenAI last quarter; one analysis suggests that it burns over $7 for every $1 in revenue.

The Information reported that OpenAI made $4.3 billion in revenue and posted a net loss of $13.5 billion in its first-half. Analysis by Matt Rossof reveals that it may have lost as much as $11.5 billion last quarter alone.

McKinsey meanwhile reported on November 5 that “for most organizations, the use of AI has not yet significantly affected enterprise-wide EBIT…”

Short the bubble?

Last week filings from investor Michael Burry (who earned $100 million with his contrary bets against sub-prime loans, in trades immortalised in the “Big Short”), revealed that he had taken short positions on NVIDIA and Palantir.

Burry has, however, been calling a bubble (pre-AI) since 2020.

NVIDIA in late October meanwhile became the first company to be worth $5 trillion. It is, as Bloomberg notes, now larger by market cap than “more than half of the 11 sectors in the S&P 500 Index” and the entire equity market of the UK.

It is also dependent for 53% of revenues for its Data Center division ($21.9 billion in sales) on just three unnamed customers, its last earnings showed.

So is this a “bubble”?

The market consensus view is still “no”. Here’s Merrill Lynch investment strategist Theodora Lamprecht on November 7.

“Strong corporate earnings, easier monetary policy, the benefit of seasonality and the beginning of a massive digital infrastructure buildout provide a solid foundation for potential growth.”

Or here’s Russell Shor, Senior Market Analyst at Tradu.com:

“Comparisons with the dot-com bubble are misplaced. Today’s AI leaders fund capital spending from strong cash flows, not the debt-heavy balance sheets that fuelled the late-1990s boom.

Shor is arguably behind the curve. As Goldman Sachs’ analyst Kash Rangan cautioned in late October, we are starting to see a “debt-fueled capital cycle… entities are being funded with 80% debt and 20% equity, with the equity portion often backed by collateral from the sponsoring entity…”

“Leverage is starting to emerge in the system,” he noted.

Also at Goldman is Eric Sheridan: “Every computing cycle I’ve ever analyzed, that has eventually led to a trough of disillusionment. I would be shocked if we avoided one this time. Beyond that, in any technology cycle, typically only 2-3 companies in the same vertical earn an excess return on their cost of capital… I see no reason why the AI cycle will prove any different.,” he said.

What are the enterprise users doing?

Down at the enterprise coalface, Chief Information Officers continue to tout AI-centric wins to AI-excited executives and investors; perhaps out of genuine enthusiasm; sometimes (based on our conversations) under duress.

(“AI is a strategic imperative owned at the C-suite level, with executive leadership recognizing that enterprise-wide AI adoption is the defining factor separating the AI haves and the AI have-nots. We're seeing C-suite driven AI transformations across our customers,” said Palantir’s CRO on November 3.)

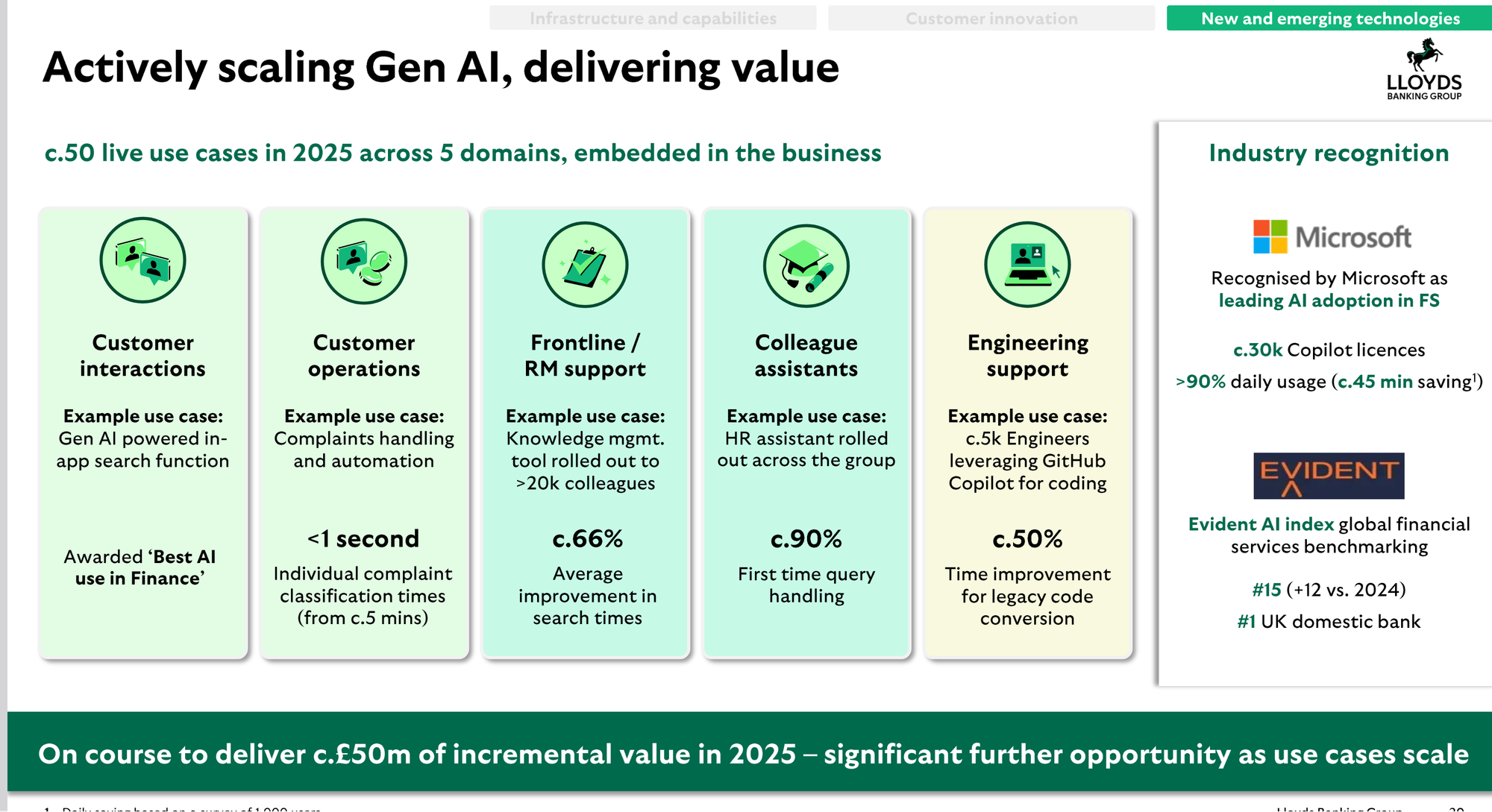

The COO of one of the UK’s largest banks, for example, just last week touted 50 life use cases at Lloyds Banking Group’s across five core domains (and a relatively modest “$50 million in incremental value” from them in 2025.)

The opportunity for transformation in many areas does appear to be significant: Research by Stanford’s Erik Brynjolfsson and MIT’s Danielle Li and Lindsey Raymond on generative AI in customer-service centers, found that AI assistance increased worker productivity by 15% and 30% with new staff.

But is- it-$1-trillion-in-spending-commitments-by-a-massively-loss-making-company-publicly-suggesting-it-wants-a-taxpayer-backstop-significant?

Russell Shor at Tradu.com insists that this is no bubble:

“What we’re witnessing is genuine technological change supported by long-term corporate planning rather than short-term excitement. The market’s enthusiasm for AI rests on solid foundations, making today’s bubble warnings seem premature.”

Jon Gill, a partner at law firm Eversheds Sutherland, notes that in the market he sees there is “definitely a… bifurcation in terms between AI and non-AI deals, with the AI deals benefiting from FOMO and attracting both better valuations, but also looser legal terms."

He told The Stack by email: "There will clearly be an adjustment at some point, though based on the deals we’re advising on there is some way to go yet…”

Sign up for The Stack

Interviews, insight, intelligence, and exclusive events for digital leaders.

No spam. Unsubscribe anytime.