semiconductors

Deal adds 1,200 SKUs to TIs portfolio of chips.

Chipmaker Texas Instruments has agreed to buy embedded wireless and Internet of Things specialist Silicon Labs for $7.5 billion – a move that it said will add some 1,200 new products to its lineup of chipsets and software.

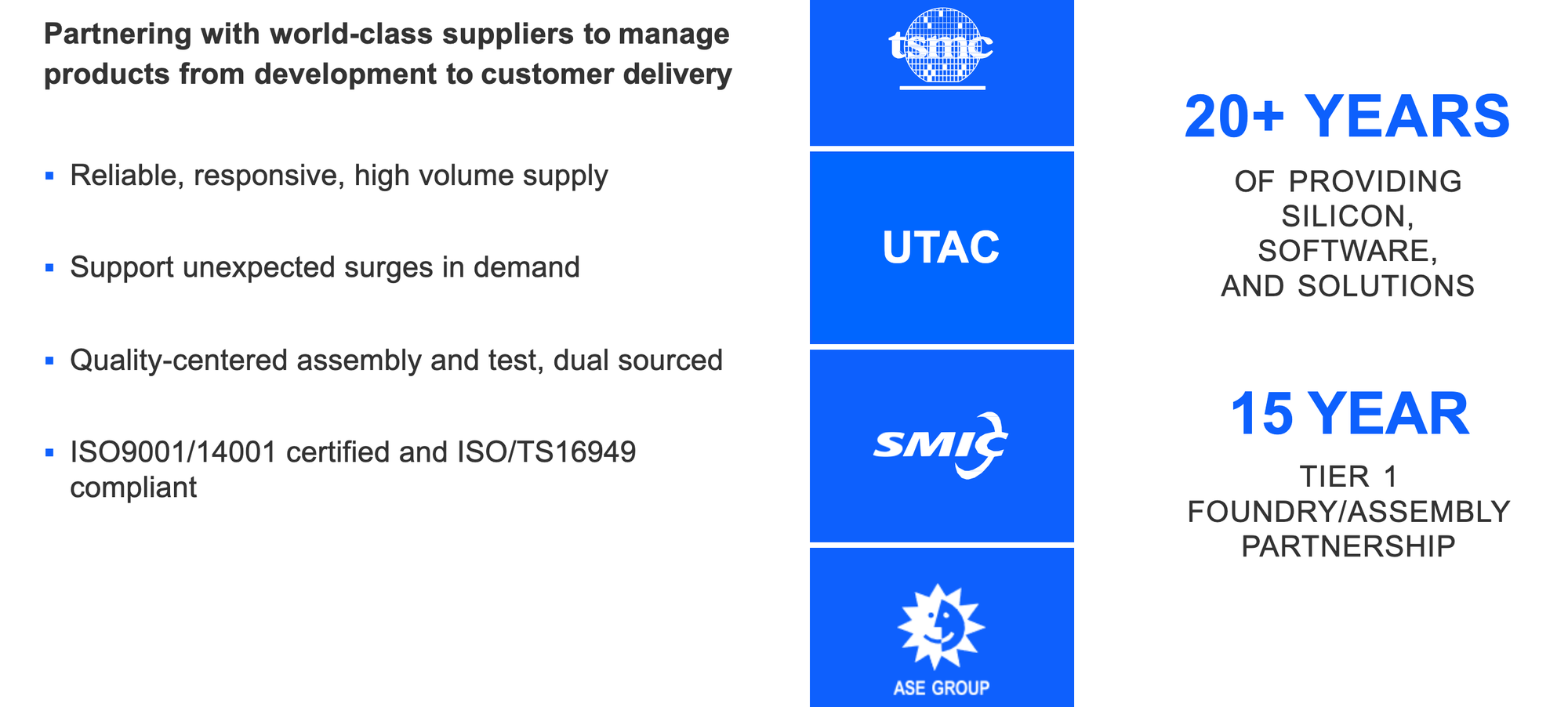

Texas Instruments said it would bring fabless Silicon Labs’ manufacturing back to America. The latter currently relies on the likes of TSMC (Taiwan), as well as Beijing fund-owned UTAC, and Shanghai-headquartered SMIC.

The boards of both companies have unanimously approved the deal.

The buyout will “deliver fully integrated process, design and manufacturing capabilities by reshoring Silicon Labs’ manufacturing from external foundries,” Texas Instruments said. The deal will generate $450 million in annual manufacturing and operational synergies within three years, it said.

Silicon Labs earlier wrote to US trade authorities in 2025, pleading for a tariff exemption: “Silicon Labs provides the silicon, software, and solutions needed for various U.S. manufacturers to create connected technology used by millions of Americans for home and industrial automation, smart meters, data centers, automobiles, medical devices, communications and more.

“Our company and customers rely on… integrated circuits, processors, controllers and voice, as well as image and data transmission devices from China…these tariffs threaten to increase the cost of our products for suppliers, customers, and ultimately the American people,” it wrote.

“We are also increasingly concerned about the macroeconomic effects of a global trade war and its negative effect on American innovation…”

Semiconductors were ultimately exempted from tariffs.

Texas Instruments said today that its manufacturing footprint includes 300mm wafer fab facilities in the US as well as test and assembly capabilities, and its “defined process technologies, including 28nm, are optimized for Silicon Labs’ wireless connectivity portfolio, enabling more efficient and faster future process technology design cycles…”

Texas Instruments said it expects to fund the transaction with a combination of cash on hand and debt financing to be arranged prior to closing.

The transaction is expected to close in the first half of 2027.