Zurich Insurance Group has made an improved $10 billion bid for British cyber insurance specialist Beazley – after an earlier proposal made on January 4 was rejected by Beazley’s board of directors on January 16.

Zurich said the offer would be financed through a mix of cash and debt.

Beazley in 2024 launched a “full Spectrum Cyber end-to-end cyber security and insurance” offering – having initially written its first standalone cyber insurance policy as far back as 2008 and led growth of the market since.

The improved offer comes despite Beazley’s move to pull back from the US market. CEO Adrian Cox told investors last month that “the U.S. cyber market is now unprofitable, given that very active claims environment…”

Zurich said that its acquisition of Beazley would create a specialty insurer with “c.$15 billion of gross written premiums, exceptional data availability and underwriting expertise, leading market and distribution capabilities and outstanding reinsurance and technology infrastructures.” it claimed.

The 1280 pence per share offer represents a 56% premium on Beazley’s closing share price of 820 pence on 16 January 2026, Zurich said.

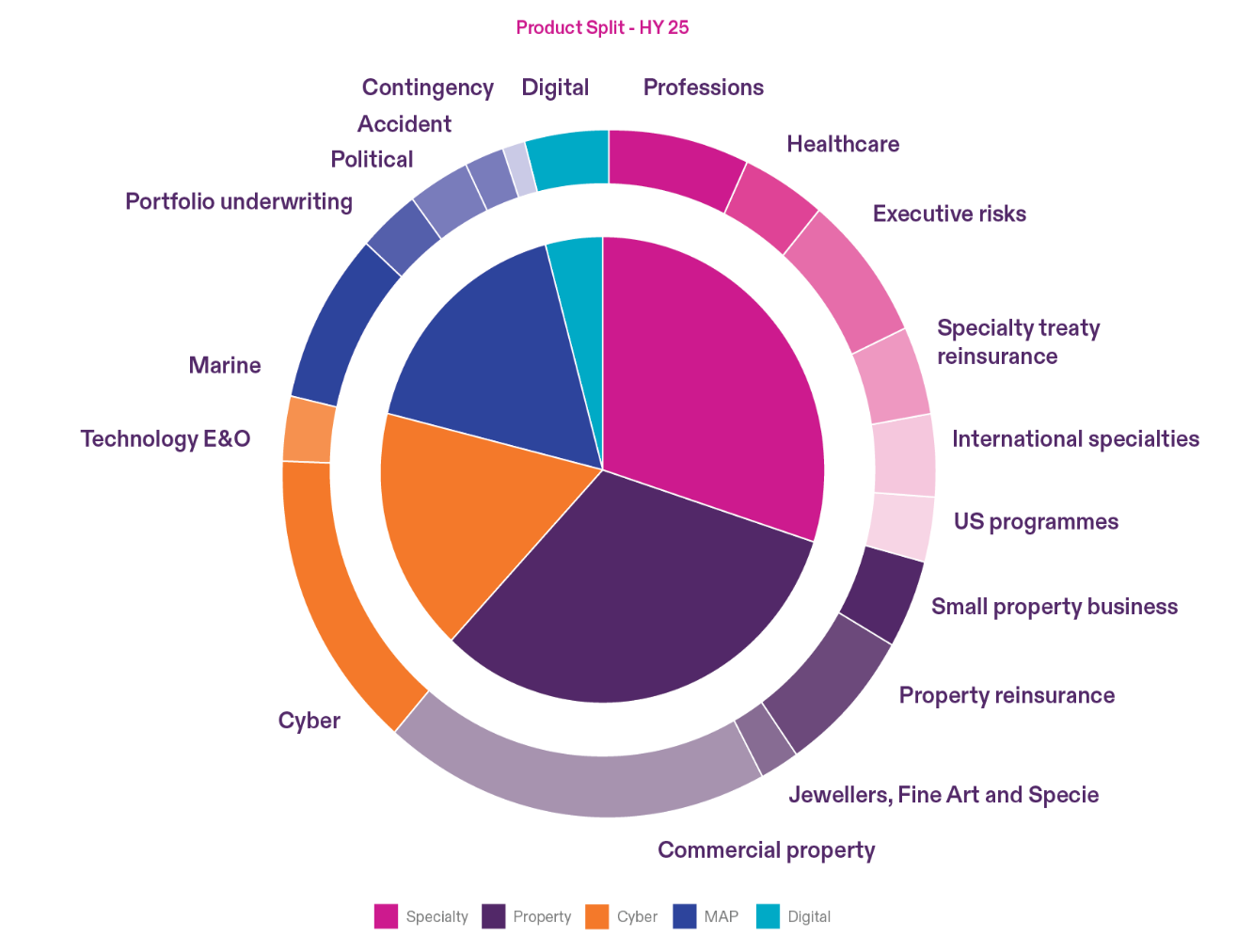

Speaking at a November 2025 capital markets day, Beazley’s Chief Underwriting Officer Paul Bantick noted that “many people think we're just a cyber player. But what this [slide below] shows is we are not and nor do we want to be. [It] shows really well is just how diversified our business is.”

CEO Adrian Cox noted at the same event that Beazley has been growing its cyber insurance proposition, including via the launch of dedicated cyber risk consultancy firm Beazley Security. It also helped issue the first ever cyber catastrophe bond in 2023 – an instrument designed to transfer the risk of a major, systemic cyber event from an insurer to capital market investors, who receive payments if a pre-defined cyber catastrophe triggers the bond.

As of last month, the firm had issued $670 million in cyber catastrophe bonds and more than $1 billion of cyber excess of loss cover, it said.

Cox added at last November’s event: “It's vital that we build a vibrant reinsurance market to allow the insurance market to hedge the systemic risk in cyber just as there is in property. And if the cyber market is going to reach the size (it's estimated that it can be some $40 billion), that reinsurance market, both traditional and alternative capital needs to grow…”