Global IT spending will hit a massive $5.43 trillion in 2025, driven by a 42% spike in data centre investments, said research house Gartner.

AI-centric compute and network investment growth is offsetting a slowdown in SaaS spend as businesses face macro headwinds it said.

But Gartner’s John-David Lovelock commented that “with GenAI sliding towards the trough of disillusionment, more time and spending is being focused on delivered functionality from incumbent software providers.”

“CIOs are looking towards more ‘plug and play’ simple use cases.”

See also: Not the CIO’s job? Getting your organisation AI agent ready – “the promise and the peril”

From Q2 there has been an “uncertainty pause” the firm noted, saying it is seeing “strategic decision to delay new expenditures. The IT hardware and infrastructure sectors are particularly affected due to price increases and supply chain disruptions. In contrast, ongoing or recurring spending, such as cloud and managed services, is maintaining greater stability.”

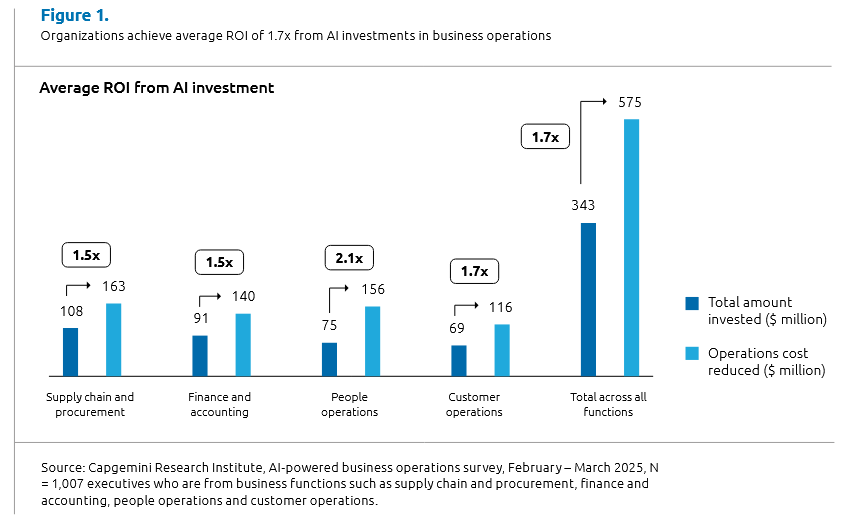

Capgemini’s “AI in Action” report in June, meanwhile, claimed that “confidence in AI's commercial viability is growing, with 40% of organizations expecting positive ROI within one to three years and another 35% within three to five years based on our survey.”

On AI agent deployment the consultancy claimed that "Initial results indicate up to a 40 – 45% improvement in key parameters following the deployment of AI agents and multi-agent systems."

Its researchers cautioned, however, that "while these figures are encouraging, they must be contextualized within the current scope and maturity of implementation. A significant portion of the observed gains can be attributed to the automation of straightforward, repetitive tasks—representing early-stage efficiencies rather than long-term transformational impact.

"Furthermore, the underlying data may be subject to bias, as it is derived from a limited number of early adopters, many of whom operate in environments that are already conducive to AI integration. The ample size remains small, and large-scale deployments are still relatively rare."

The five sectors showing the highest year-on-year rise in investment in Gen AI are consumer products (73%), insurance (70%), banking (67%), aerospace and defense (65%), and telecom (64%), the consultancy found.