The Stack is resurfacing some of our favourite "Big Interviews' from 2025 as we close off the year. This piece first appeared on November 11.

Updated 17:16 GMT November 11, to clarify reporting line of the bank's CDO.

Bank of England CIO Nathan Monk joined the central bank in 2018 to work on the rebuild of its settlement engine – the hardware and software stack at the heart of how financial institutions settle payments made across the country.

Seven years later, the “real-time gross settlements” (RTGS) engine has been rewritten, moved from mainframe to x86-based modular, cloud-native architecture that now runs on a private cloud* – and in Q3 2025 on average, settled £796 billion, or the equivalent to a third of UK GDP, daily.

Sitting down to chat with The Stack in a meeting room at the central bank’s famous building on Threadneedle Street, Monk looks lightly shell-shocked that the job has been done successfully – and indeed that he’s now CIO.

“I feel very lucky and honoured to have the role, especially in an establishment such as the bank; I never thought as a kid I'd ever have such a great role as this,” he says modestly. (Monk was the first in his family to go to University. He credits his mother for sending him to a summer computing course after finishing school that gave him a “real bug for computers!”)

“I genuinely do love my job!” he says.

“But it’s not without its challenges…”

*The BoE declines to break out technical details, but notes the “core settlement engine does not rely on third party availability for its own availability.”

“Lots of grey hairs…”

The RTGS was a true monster of a programme, ultimately delivered successfully in partnership with Accenture, whose support Monk is quick, unprompted, to praise. (Accenture had no involvement in this interview.)

“It was a generational opportunity” he says, and “one of the appeals for me to move to the bank [as a technical director]. It's been an amazing experience. (At the peak of the programme the bank had some 500 people working on it.)

“I've got a lot of gray hairs as well, right? It's not been all completely ‘butterflies and swallows.’ It's been a really challenging programme…” (It’s also, like so many large technology programmes, never entirely finished. The bank is looking to iterate on its new platform and is hiring to help with this.)

Monk says his team was able to work with multiple potential delivery partners on competing design processes as they planned the migration.

“Co-sourcing the design”

The Bank of England’s CIO adds: “We went through a series of different gates to get down to five, to three, to one, and as when we got down to the three, we were working with them all, kind of co-sourcing the design… we had [contractual] provisions to be able to do that throughout the process.”

The final delivery partner, Accenture, has “done a really good job for us,” he volunteers. “it's been a really good engagement with them. But it stems from having the right kind of leadership here at the bank… trying to leave the commercials at the door and let [technology team] focus on the outcome.”

Part of that was due to having an involved and invested business sponsor who really understood the challenge, and opportunity for innovation, he says; praising the bank’s Victoria Cleland for her leadership of the project.

Changing how technology works

Engagement with market participants was also helpful: “The architecture was [a known-known]” he says; “we knew how we interface and we work with payments very well, with Swift in the middle. So we know the channels in which we operate… [but] we consulted around how they interact and use the system. What were their pain points on the system and the processes?

The move was a chance to modernise the technology stack but also, Monk says, “the way we worked at the back-end as well; we've really modernized that. We've got ‘fusion teams’ now… basically our business teams and my technology team sit together, all focused around the outcomes of the platform, rather than having a traditional technology department.”

How has that played out with internal staff?

The Bank of England’s CIO responds: “[We wanted to] run [the program] in a more agile way, rather than traditional waterfall. It’s had lumps and bumps, as you would imagine, people finding their feet, but we did a lot of training with our colleagues…it felt alien at the start, now it’s just normal BAU operations.”

What’s next?

Time for the CIO to put his feet up and just keep the lights on?

Hardly. The Bank of England’s over 330-years-old.

As well as sitting on vaults full of gold bullion, it’s also sitting on plenty of legacy technology; the RTGS wasn’t the only fish to fry on that front.

Next up? Modernisation of its ERP systems, for example.

Monk won’t name the software but public contract notices show it’s running both SAP and Oracle systems; the former dubbed “a highly configured estate with complex and high value logistics” in one 2023 tender notice. (For technology-use-trackers, newer notices show contracts for Temenos T24 support, whilst open job roles show the bank is running SailPoint for IAM.)

He says: “Any ERP is the difficult thing; it goes right at the heart of everything organizations do… so it's making progress, but it’s challenging, like any ERP is. I've done a few of them in my time; hence why I've got grey hair.”

“A really big agenda”

“We've got a really big agenda,” says Monk.

“One of our kind of strategic imperatives really, is being fit for the future.

“So there's a hell of… there's a LOT of work going on at the moment around markets, banking and payment, and making sure we've got the right systems and platforms to facilitate the processes that we run… so, hosting: on-prem infrastructure; make sure that's all up-to-date and working,” he says.

(The bank just expanded a long-standing technology services framework by £14 million to £101 million; the supporting partners and SIs registered on it include Accenture, Axiologik, Civica, Coforge, Cognizant, Credera, EPI-USE, ITC Infotech, Mastek, QA Ltd, Telstra UK, Ten10, Version1, documents show.)

“We’re trying to be ‘cloud-smart’”

Monk adds: “One thing I do want to say is that it's a hosting strategy, not a cloud strategy; [we’re trying to be] ‘cloud-smart.’ So not just chasing the cloud for the sake of the cloud… we're trying to make sure we're selecting the right hosting environment for the right application.”

He admits that “we're pushing to a certain cloud provider; we've got a good partnership with them that we're building out at the moment and we're consuming a lot of the Productivity Suite from them as well at the moment,” [readers don’t need to be a genius to guess that this is Microsoft.]

“We've got a big infrastructure partner, which we're working very closely with as well at the minute… [and are driving] a lot of SaaS adoption.”

“A common plane…”

Does the bank have any firm targets for moving X applications to Y environment, The Stack asks? “We've got a target that we're shooting for, and we're on that journey,” he replies, adding “we've still got quite a lot to do!”

“ I want to make the look and feel for our end users… like a common plane across the top of them… give a menu choice… So almost be led down a decision tree, like ‘it's this type of data, this type of availability [needed]’, then it starts to route you down this kind of infrastructure [or] offerings.”

Threadneedle St. to Leeds…

Another big priority the Bank of England CIO has is building up its technology hub in Leeds. The central bank already has a solid presence there and Monk says that “we are building out data capabilities in that space… as well [people to] maintain and run that [ERP] platform for us…

He adds cheerfully: “There’s a lot of [people with] digital skills up in Leeds! I think we’re publicly committing to getting 500 seats there…”

The central bank is also looking to be flexible in how it recruits with a "balance of in the office and having the flexibility to be at home" he says; it's looking for experienced cloud talent he says and although it can't compete with a Google, for example, "we do have the ability to attract and retain talent... we're working on some quite sexy stuff!"

Data challenges...

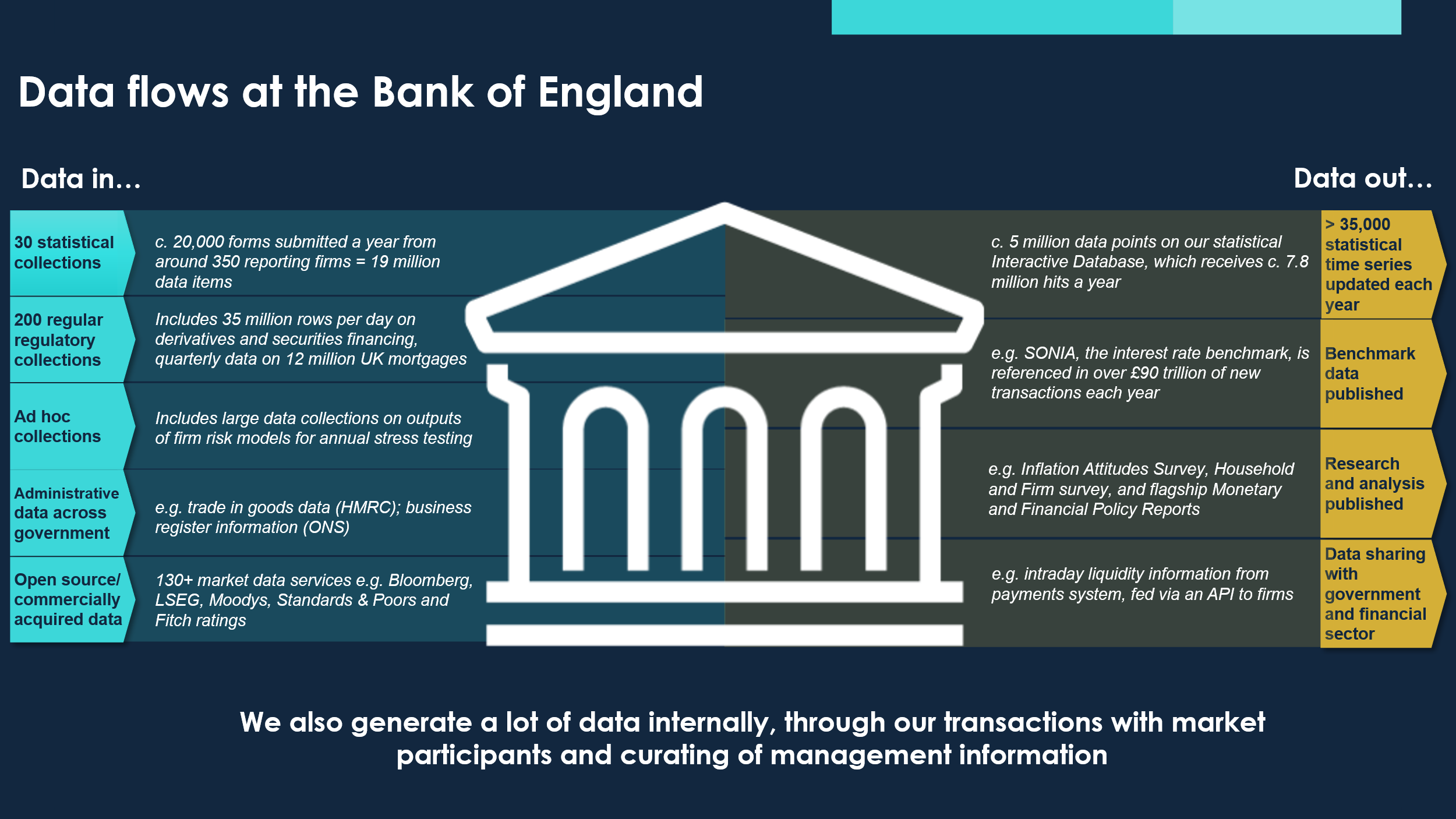

Then there’s the ‘classic’ challenge of breaking down data siloes, cleaning up datasets and providing the right technology platforms for the bank’s data.

That includes efforts to “harmonize, standardize, simplify collection of data; then, once we've got it, where are we storing it? How [do] we make it available and stop buying the same data multiple times around the organization” he explains – the bank is bringing in a new Chief Data Officer to support those efforts, operating as a peer to Monk and reporting to its Chief Operating Officer Sarah John and deputy governor for monetary policy Clare Lombardelli. (Both its CTO and CISO, meanwhile, report to the CIO…)

Monk adds that “we've got a lot of Python and R users within the bank, which is great… [they] are quite a demanding group of individuals that want to be able to have the right systems, the right access to data, the right laptops…”

“I love that! I love people coming to me and going ‘we really need this’ [and having the conversation around] ‘what's the business problem you’re trying to solve?’ and then ‘here's the capabilities we've already got’ or ‘actually we might need to do something differently; my mission, really, from technology is about how we enable and empower our organization…” he concludes.

New ‘DG CIO’ roles

Does the “business” understand the CIO’s challenges and what technology is trying to achieve? The Stack asks. It’s a storied entity after all, and a rich heritage in a particular domain doesn’t always equate to a good understanding of broader technology-driven innovation opportunities.

“Yeah, there's a really great awareness we're getting,” he responds.

“I’m not saying we've got tons of money, but we're getting good investment in the priority areas… we really need them. I've changed the organization structure [as I] I want to be seen as the go-to partner for our businesses.

Monk explains: “We created these ‘DG CIOs’ [roles]; CIOs that are embedded into Deputy Governorship leadership teams now… we've been going at that for quite a few months and it’s starting to bear some really good fruit…”

He adds: “It helps the business really understand what we're about as a department. We're not just here to provide room-tech and laptops!”