Citigroup’s technology expenses in fiscal 2023 hit $12.2 billion, as the world’s sixth largest bank continued to spend on digital transformation – but announced a huge wave of layoffs amid controversial restructuring.

An organisational shakeup in late 2023 put co-CIOs, Stuart Riley and Shadman Zafar, in charge of technology modernisation and shifted focus from geographical divisions to Citi's five individual business units.

“We've invested heavily in our transformation” said Jane Fraser on a full-year 2023 earnings call late Friday. “While that was catalyzed by our consent orders, these investments will ultimately deliver benefits from automation, from well-governed data, from consolidated platforms...”

(Several US regulators in 2020 hit Citigroup with multiple consent orders, or legally binding demands, with the Federal Reserve blasting “significant ongoing deficiencies [in] risk management and internal controls, including for data quality management and regulatory reporting, compliance risk management, capital planning, and liquidity risk management.”)

Citi layoffs: 20,000 to go

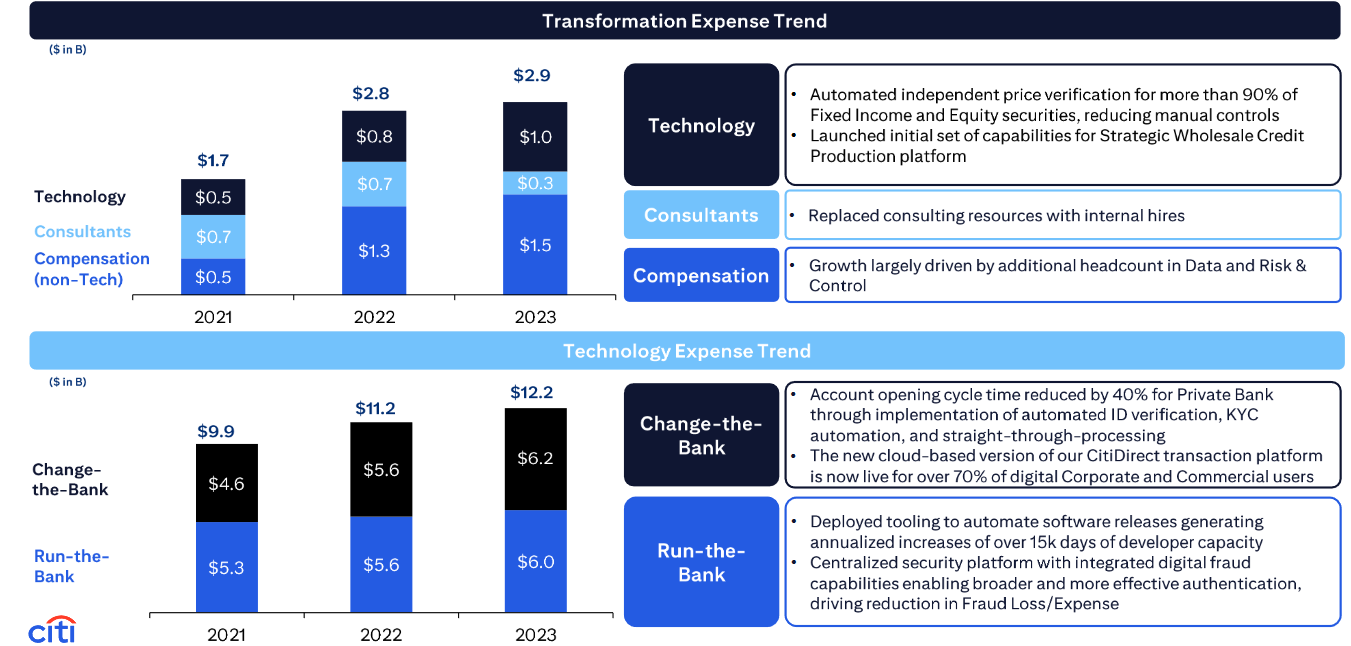

The bank retired 6% of its legacy IT applications in 2023, executives said.

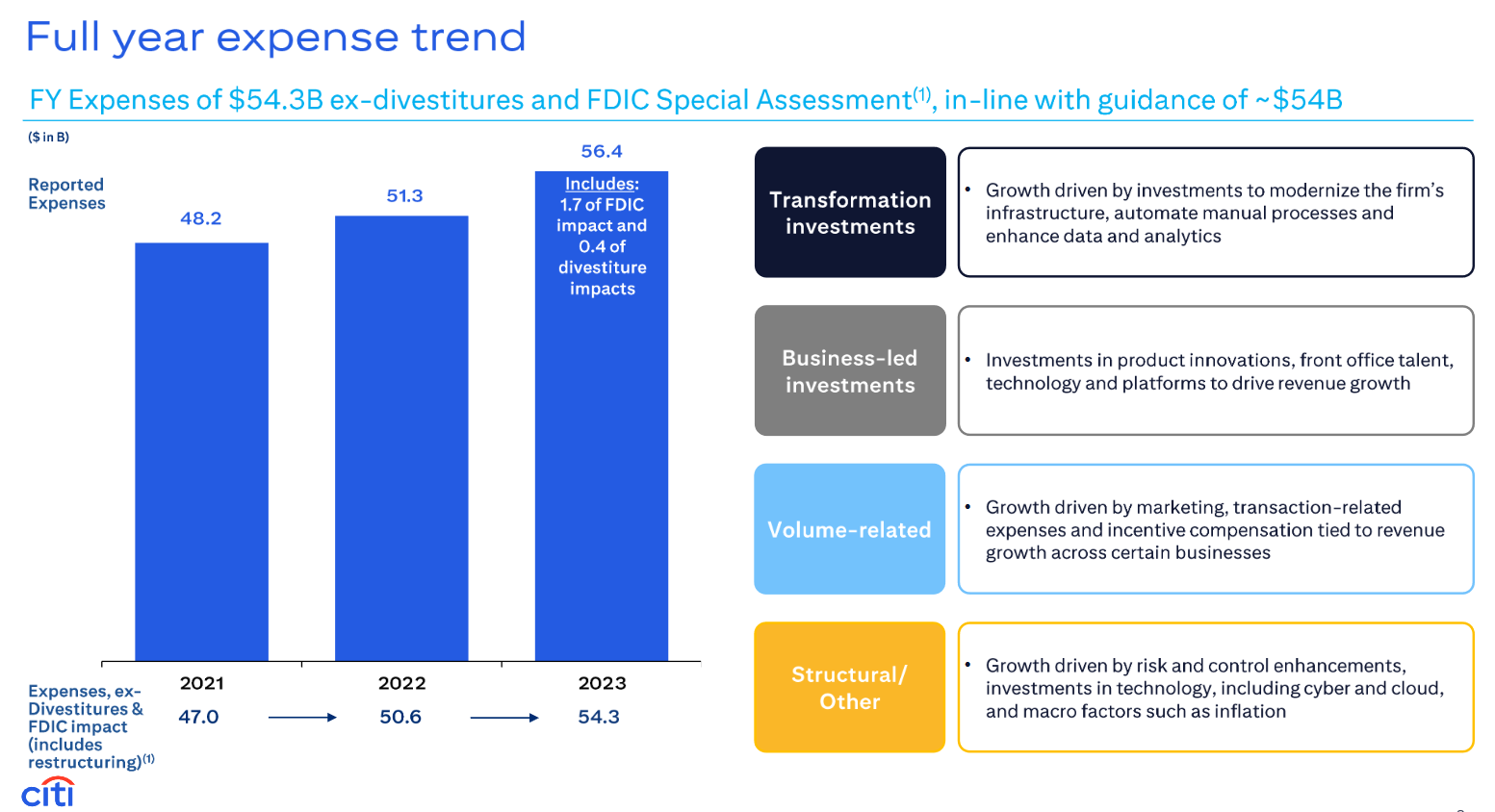

Redundant technology was not the only thing getting the chop however: Some 20,000 staff at Citi will lose jobs under a new round of restructuring, in part in a bid to drive down OpEx, which hit a record $56 billion in 2023.

(Citi told The Stack that it was not breaking out the regional impact of the layoffs – and that they would complete by the end of Q1.)

Analysts on an earnings call were not convinced: “Severance is $700 million to $1 billion in '24. It doesn't seem like there's a tonne of actual cost saves in that number…” said Seaport Global Securities Jim Mitchell.

Citi’s CFO Mark Mason responded on the Q4 call: “We're continuing to invest in risk and controls and in the transformation over this period of time… There's an increase in expenses associated with at least those two things, and that's offset by the savings that we're starting to generate...”

These claims were met with some scepticism by investors however; weary of overhyped restructuring talk at the bank: “I've not spoken to one person or any investor who would say that Citi has succeeded on its prior restructuring… I count 12 restructurings that have failed at Citigroup” said Wells Fargo Securities’ analyst Mike Mayo bluntly, addressing executives.

“Well thanks for that Mike” responded CEO Fraser.

"I fully recognize that 2024 is an inflection year and I and the management team are accountable to deliver..." she said, adding on the call that "we've [moved] 20 of our cash equity platforms onto one, six reporting ledgers onto one, 11 sanctioned platforms onto one. We start seeing some of the benefits of those come in other things. We automated independent price verification for 90% of our prioritized fixed-income and equity securities.

“That's reduced manual controls, that's improved valuation consistency, that's also had an impact on the efficiency of the business,” she added.

See also: Citi CTO spearheads new pan-industry ‘Common Cloud Controls’ project at FINOS

“We've loaded 98% of our prioritized wholesale and consumer data into two authorized repositories. That will also begin to start having some benefits for us. So, there is a cumulative effect that is beginning to build now from all the work we've done” she said, as a presentation showed a 49% – 51% split between “run-the-bank” and “change-the-bank” spend.

The former’s $6 billion in annual technology outlay included the creation of a new centralised security platform; whilst the $6.2 billion for the latter included significant investment in know your customer (KYC) automation.

“Beyond transformation, our technology investments are also focused on digital innovation, new product development, client experience enhancements, and areas that support our infrastructure like cloud and cyber” Citigroup CFO Mark Mason told analysts on the January 11 call.

Mason added: “There are three drivers that will reduce our expenses: organizational simplification, including the reduction of management layers; eliminating stranded costs as we take additional actions to reduce excess overhead in light of the exit markets; and realizing productivity savings from our investments in the transformation and technology.”