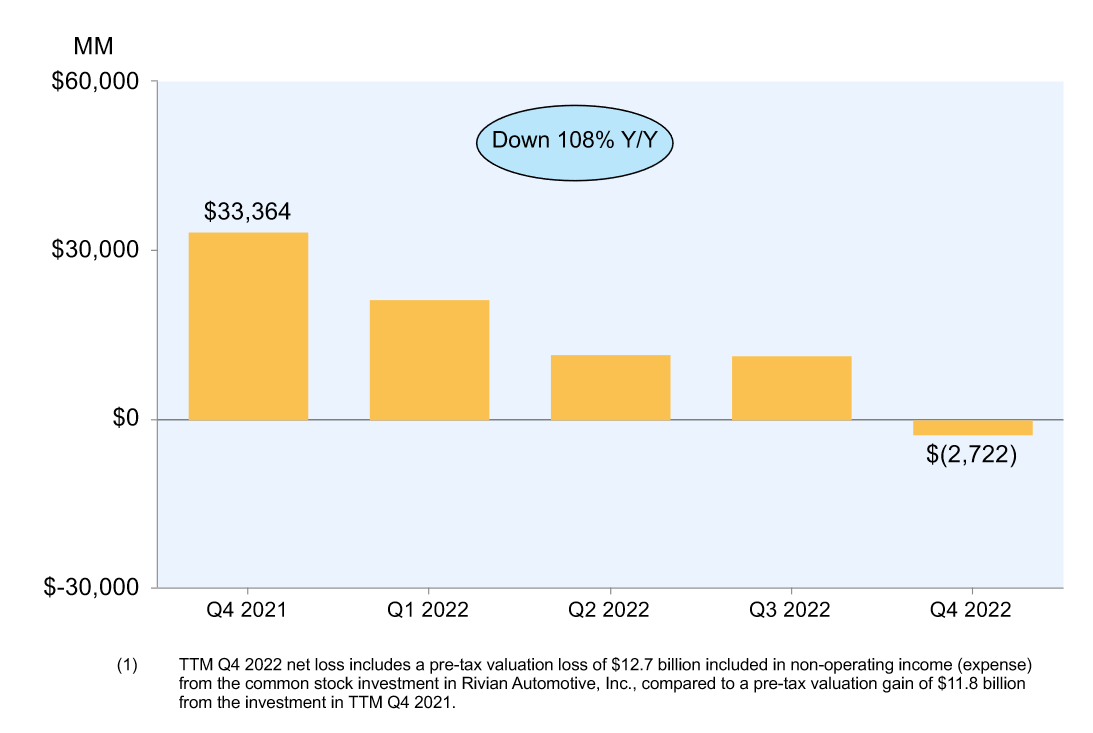

Despite growth slowing notably, AWS revenues in 2022 hit $80.1 billion, Amazon's Q4 earnings showed – but could not stop the company from seeing net income slump from $14.3 billion to $0.3 billion year-on-year.

Eliminating 18,000 roles cost Amazon $640 million in severance whilst FX headwinds hit it for $5 billion in Q4. Property and equipment impairments also stung Amazon as it trimmed facilities, as did insurance changes.

AWS growth itself slowed to the “mid-teens” in January 2023 amid a broader economic slowdown, executives admitted on an earnings call, with Amazon CFO Brian Olsavsky highlighting examples of declining cloud use.

“Things like financial services… as mortgage volumes down, some of their compute volumes are down; lower trading in crypto; things tied to advertising… there's less analytics and compute on advertising spend as well.”

“What we're seeing is… a priority by our customers [sic] to get their spend down" he said.

During the quarter Amazon launched AWS Regions in Spain and Switzerland as well as a second Region in India to continue expanding AWS’s infrastructure footprint. AWS now has 96 Availability Zones within 30 geographic regions globally, with announced plans to launch 15 more Availability Zones and five more AWS Regions.

Follow The Stack on LinkedIn for events and more

The 20% Q4 growth – albeit from a higher absolute level – is down from 34% growth in Q4 of 2019 for example.

Amazon CEO Andy Jassy – who previously led AWS – joined the earnings call, telling investors that he saw still huge runway for the cloud with a majority of workloads remaining on-premises and reiterated some of the idiosyncrasies from a provider perspective of having delivered something designed to be so flexible.

“We’re trying to build a set of relationships that outlast all of us” Andy Jassy

“The reality is that the way that we've built all our businesses, but AWS in this particular instance… we're going to help our customers find a way to spend less money… we're trying to build a set of relationships in business that outlast all of us. So if it's good for our customers to find a way to be more cost-effective in an uncertain economy, our team is going to spend a lot of cycles doing that… That elasticity is very unusual [but] to our best estimations we still have significantly more absolute dollar growth than anybody else we see in this space," he said.

“I think it's also useful to remember that 90% to 95% of the global IT spend remains on-premises… I don't think on-premises will ever go away, but I really do believe in the next 10 to 15 years that most of it will be in the cloud if we continue to have the best customer experience, which we have to work really hard [to deliver].”

Amazon started with books, moved to the cloud; what’s next?

Amazon continues to explore new growth opportunities and will invest to do so, Jassy added.

He said: “When I got to Amazon 25 years ago, we were a books-only retailer. And when we expanded into music and video and electronics, that seemed pretty natural to people. Amazingly, people were very surprised we were expanding into tools. That seemed far-field for people, but it turned out not to be..."

https://twitter.com/dvassallo/status/1622643905127915520

“I had a front-row seat in the AWS experience, having worked with the team and led the team from the very start. I remember both externally and internally, there were a number of people who wondered why we were doing that. It was so different from retail only. But think about how different a company Amazon would be today if we hadn't invested in AWS. So that informs some of the other meaningful investments we're making" Jassy added.

We are very enthusiastic about our investments in streaming entertainment devices, our low Earth Orbit Satellites, and Kuiper, healthcare and a few other things. Do I think every one of our new investments will be successful? History would say that that would be a long shot. However, it only takes one or two of them becoming the fourth pillar for Amazon for us to be a very different company over time.”