The Bank for International Settlements (BIS) or "bank for central banks" says central bank digital currencies (CBDCs) will be at the heart of the future monetary system in a landmark new chapter in its annual economic report -- even as it warned of the "deep structural inadequacies" of decentralised cryptocurrencies.

"A monetary system based on central bank public goods, using a digital version of sovereign currency as its foundation, could foster innovation while safeguarding stability and security" it said.

Its "blueprint for a future digital monetary system" deserves close attention: BIS is owned by 63 central banks, representing countries from around the world that account for 95% of world GDP and is an influential shaper of future central banking trends. It has assets of over $400 billion, takes deposits in currency and gold, and provides asset management, foreign exchange and gold services to other central banks globally.

In the report the BIS pointed to deep "structural limitations that prevent [DeFi and crypto] from achieving the levels of efficiency, stability or integrity required for an adequate monetary system... the crypto universe lacks a nominal anchor, which it tries to import, imperfectly, through stablecoins. It is also prone to fragmentation, and its applications cannot scale without compromising security, as shown by their congestion and exorbitant fees".

"There are serious concerns about the role of unregulated intermediaries in the system. As they are deep-seated, these structural shortcomings are unlikely to be amenable to technical fixes alone. This is because they reflect the inherent limitations of a decentralised system built on permissionless blockchains" it added on June 21.

BIS Central Bank Digital Currencies blueprint

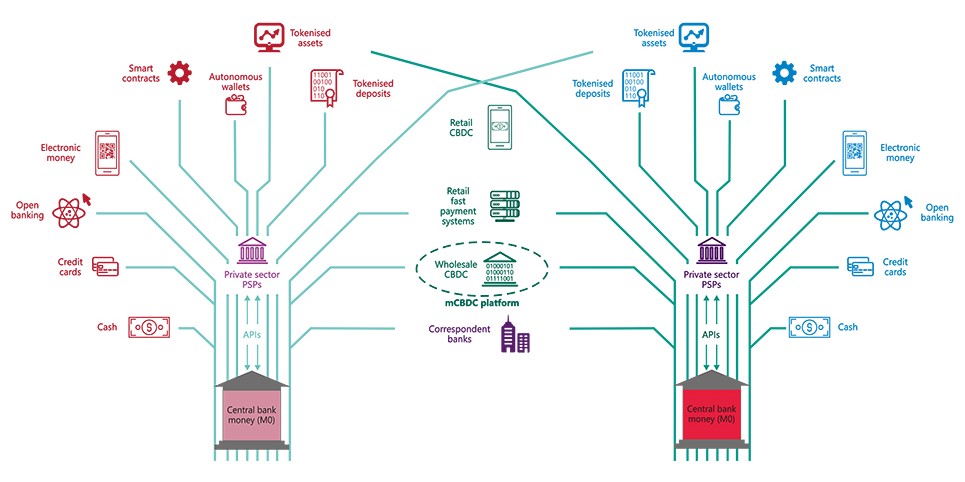

The BIS argues that the future monetary system should be the fusion of new capabilities around the core of trust provided by the central bank. The private sector will provide customer-facing activities with new functions such as the tokenisation of money and financial instruments and instant retail payments through new interfaces: "This combination could bring about lower costs, greater financial inclusion, more user control over financial data, improved integrity and seamless cross-border activity" the BIS said on June 21.

"Within the new functions unlocked by wholesale CBDCs, one set of applications deserves special mention – namely, those stemming from the tokenisation of deposits (M1), and other forms of money that are represented on permissioned DLT networks" it ermissioned DLT networks" it added.

"The role of intermediaries in settling transactions was one of the major advances in the history of money, tracing back to the role of public deposit banks in Europe in the early history of central banking. Bank deposits serve as the payment medium, as the intermediary debits the account of the payer and credits the account of the receiver. The tokenisation of deposits takes this principle and translates the operation to DLT by creating a digital representation of deposits on the DLT platform, and settling them in a decentralised manner.

"This could facilitate new forms of exchange, including fractional ownership of securities and real assets, allowing for innovative financial services that extend well beyond payments" BIS concluded.

Get yourself following the Stack on LinkedIn

It's a view shared by Swiss exchange operator SIX's Executive Board Member and Head of Markets Thomas Zeeb who earlier told The Stack: “I truly believe that we are going to see more changes in how capital markets function over the next 15 years than we’ve seen probably in the last 400 years. The payments and securities areas are going to change very, very dramatically. We want to be both shaping that, and at the forefront of this shift.”

BIS blueprint meanwhile comes months after The Boston Federal Reserve Bank and MIT have released their research, dubbed Project Hamilton, into a proposed theoretical Central Bank Digital Currency (CBDC), which they developed using open-source research software. The research team said that they successfully created two architectures: one with a core processing engine capable of handling 1.7 million transactions per second.

The two did not rely on distributed ledger technology, saying that a) it wasn’t necessary to match the “trust assumptions” under their approach; i.e. that the CBDC would be administered by a central actor and b) that “even when run under the control of a single actor, a distributed ledger architecture has downsides… it creates performance bottlenecks, and requires the central transaction processor to maintain transaction history, which one of our designs does not, resulting in significantly improved transaction throughput scalability properties.”

"New private applications will be able to run not on stablecoins, but on superior technological representations of M0 (central bank money) such as wholesale and retail CBDCs, and through retail FPS [fast payment systems] that settle on the central bank balance sheet" BIS said in its blueprint for a future digital monetary system.

"Retail CBDCs and FPS share a number of further key features and can thus be seen as lying on a continuum. Both are supported by a data architecture with digital identification and APIs that enable secure data exchange, thus supporting greater user control over financial data. By providing an open platform, they promote efficiency and greater competition between private sector PSPs, thus facilitating lower costs in payment services... New capabilities such as programmability, composability and tokenisation are not the preserve of crypto, but can instead be built on top of CBDCs fast payment systems and associated data architectures" it said.