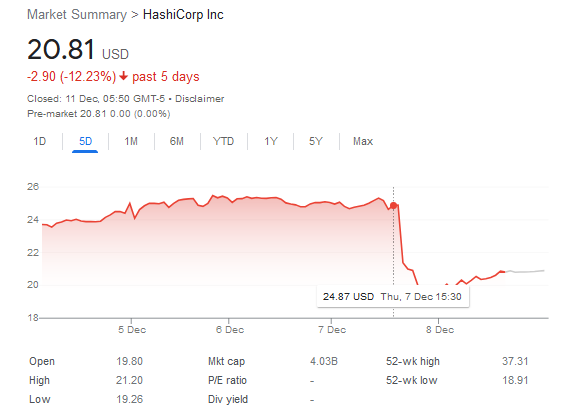

HashiCorp’s share price tumbled 18% last week after it announced earnings that disappointed Wall Street. Common or garden variety market volatility aside, what did the Infrastructure-as-Code company’s earnings and subsequent tumble say about the software market?

To HashiCorp’s CEO “it's no secret that market conditions remain difficult” – Dave McJannet suggested that “we're clearly coming out of a period of aggressive investment in software in the Global 2000… that cohort of companies is digesting the entitlement that they have purchased.”

The numbers elsewhere agree with that prospectus. Pay-per-use cloud providers have also seen end-users become far more fiscally disciplined as CIOs around the world take more of a “you own it and you pay for it” approach to the infrastructure their developer teams are deploying.

See also: Airbnb's AWS costs were getting out of hand. Here's how it tackled them

HashiCorp had reported revenues of $146.1 million for Q3; up 17% year-over-year. Net losses were $39.5 million, down from $72 million. The company now has 4,354 customers, including 877 worth $100k+ ARR.

The company describes itself as providing a “consistent way to provision, secure, connect, and run any infrastructure for any application.”

HashiCorp, which divides its revenues between IaC licenses and security ones, has also had to grapple with some industry blowback from a recent software licence change for its flagship Terraform product, but “open source” was mentioned only fleetingly on the earnings call, with one analyst asking if the company had seen any evidence of budget-tightening leading to customers swapping paid-for licences for free open-source ones. “No” was the short answer from CEO McJannet, who said that “there are certainly instances where if someone is under extreme budget pressure, they might do that temporarily, but that is sort of a bit of an anti-pattern you certainly hear about it anecdotally… it’s not common.”

See also: AWS launched 3,300 new features in 2022 but Andy Jassy has his mind on...

HashiCorp offers a “Cloud Platform” that lets organisations run its suite of products as managed services across providers like AWS and Azure.

To at least one analyst, it was curious that despite being a company dedicated to supporting others’ cloud infrastructure, its own cloud-centric revenues were so low. Pat Walravens of JMP Securities noted that when MongoDB “were at roughly $150 million in total revenue, the cloud was 47% of total revenue and growing 61%.

“You guys have $150 million in quarterly revenue, the cloud is $14 million… what [do] we need to understand about the difference between a database that's moving to the cloud and Hashi's infrastructure solutions?” he asked on the call. To McJannet the answer was simple.

“The major difference is, if I think about something like a database like Mongo versus the solutions we have, it's where they sit in the stack and their level of criticality. What I mean by that is obviously, database is critical, but typically, it's bound to the scope of a single application, right?

“...When you think about our solution, by virtue of being infrastructure, they span horizontally across usually hundreds, thousands [of applications], if not the entire estate, right? And so if you think about something like Vault, you might have hundreds of applications connected into it. So the criticality is different. As a result of that, the customer's willingness to have that outside of their control when something goes potentially wrong is very different. And I think that's the feedback we consistently get from our customers is, ‘guys, this is Tier 0 software, if I lose Vault, if I lose Console, my data center goes down’

“So I think that willingness to let a third-party run it where they don't necessarily have the direct operational control; it's just a much higher bar.

Contradicting himself slightly, he added: “When you think about what are the vendors these folks really trust, it's effectively Amazon, Azure or Google right? Even that was a position of trust that took many years for the cloud to get to within these enterprise vendors… The good news is we're seeing that shift, right? And so I think we're increasingly seeing our enterprise customers realize they don't have the operational expertise to operate this the way we do. So we are starting to see even our largest enterprise customers go down the path of HCP [HashiCorp Cloud Platform] so we're excited about that. Particularly, we see a difference in behavior between our sort of run time products and non-run time.

“For non-runtime tools, like Terraform, for example, there's more willingness. I think that's why next year, we're looking at really defaulting a land motion to Terraform Cloud because we feel like we're at that point where customer willingness is there, platform capability is there.”