JPMorgan Chase has now spent over $2 billion building new “cloud-based data centers” and has migrated approximately 38% of its applications to the cloud, Chairman and CEO Jamie Dimon has revealed, adding that the bank now has 300 AI use cases in production across customer experience, fraud, marketing, and risk.

In his annual letter to shareholders, Dimon said “this journey to the cloud is hard work but necessary.”

“Unlocking the full potential of the cloud and nearly 550 petabytes of data will require replatforming (putting data in a cloud-eligible format) and refactoring (i.e., rewriting) approximately 4,000 applications,” he added.

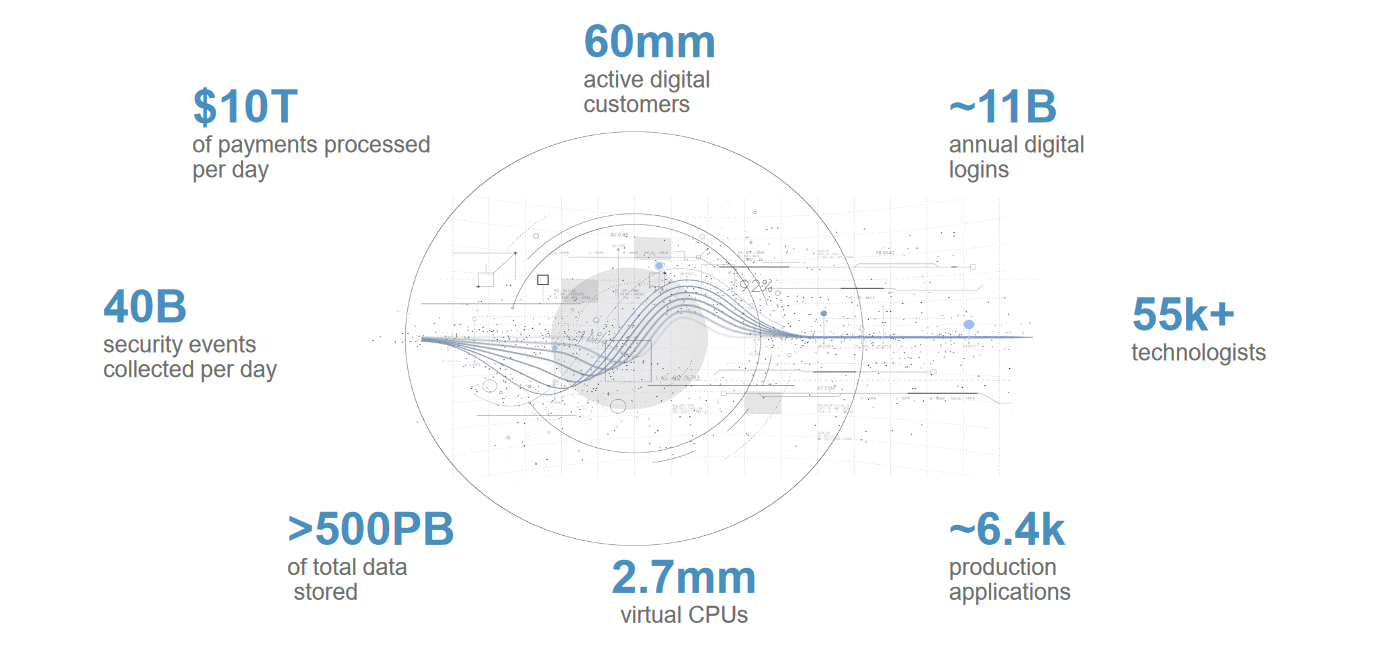

JPMorgan’s technology estate helps it process around $10 trillion in payments daily, track 40 billion security events daily and support 60 million active digital customers. Its compute and storage volumes have more than doubled since 2015, a 2022 investor day presentation showed, with the bank’s IT leaders aiming to consolidate from 33 to 17 global data centres by 2025 and slash hardware provisioning time by approximately 95%.

JPMorgan cloud migration will support more AI use cases

The shift comes as investors chafed at what one described on the company’s most recent earnings call as “the third year in a row of about $5 billion of expense growth” with a technology shift behind much of that growth. JPMorgan spent some $14 billion on technology in 2022 (run the bank expenses accounting for $7.4 billion), telling analysts on a frank earnings call that “if we don’t… we’ll be clunky and inefficient and hamstrung in the future when we’re trying to compete”. That will include getting card payments off mainframes, investing in multicloud-powered applications running as microservices and billions on brand new data centres, he added.

The ongoing JPMorgan cloud migration will be critical to deploying more AI, Dimon said.

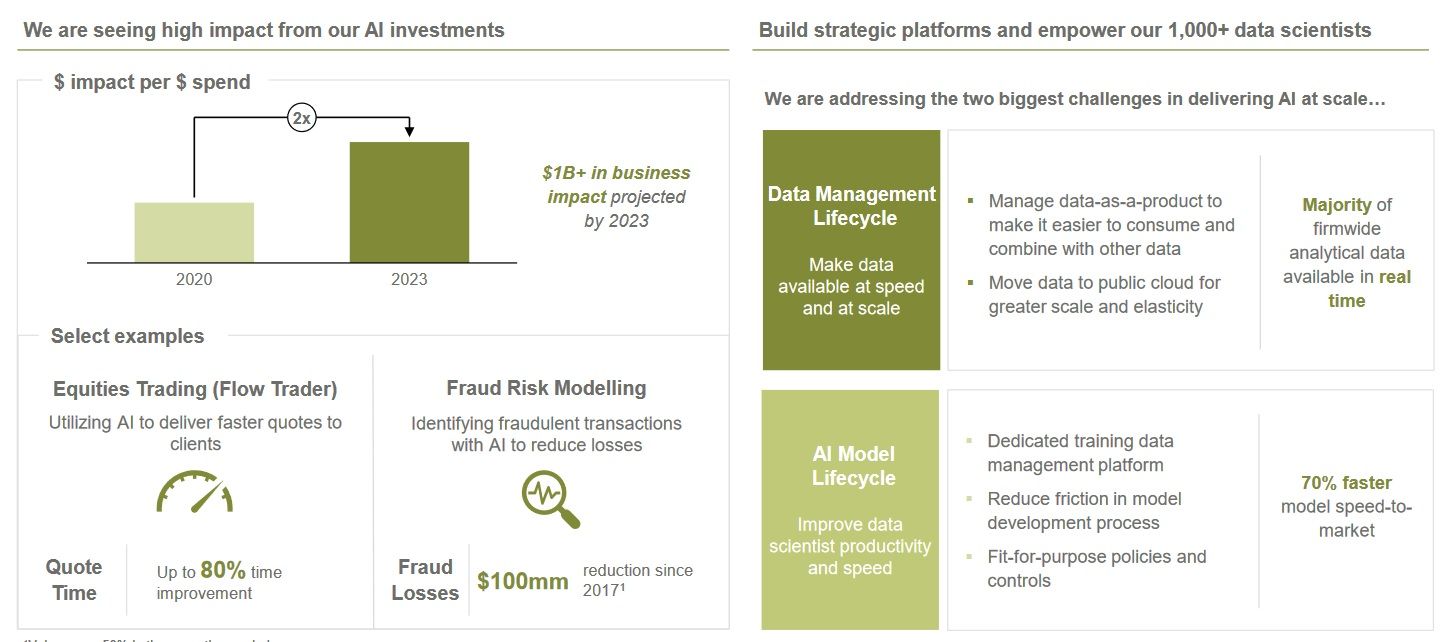

"Artificial intelligence (AI) is an extraordinary and groundbreaking technology. AI and the raw material that feeds it, data, will be critical to our company’s future success — the importance of implementing new technologies simply cannot be overstated. We already have more than 300 AI use cases in production today for risk, prospecting, marketing, customer experience and fraud prevention, and AI runs throughout our payments processing and money movement systems across the globe. AI has already added significant value to our company. For example, in the last few years, AI has helped us to significantly decrease risk in our retail business (by reducing fraud and illicit activity) and improve trading optimization and portfolio construction (by providing optimal execution strategies, automating forecasting and analytics, and improving client intelligence).

See also: Pssssst, CTOs: Free, open source ChatGPT alternatives are landing

JPMorgan had $26 trillion+ assets under custody in 2022, Dimon added in his April 2023 letter.

He took a moment to criticise "erratic" regulatory pressures as well...

"We should decide a priori what should stay in the regulatory system and what shouldn’t. There are reasons for certain choices, and they should not be the accidental outcome of uncoordinated decision making.

"Regulatory arbitrage is already forcing many activities, from certain types of lending to certain types of trading, outside the banking system. Among many questions that need definitive answers, a few big ones would be: Do you want the mortgage business, credit and market-making, along with other essential financial services, inside the banking system or outside of it? What would be the long-term effect of that choice? ... It is in the interest of the financial system that banks not become “un-investable” because of uncertainty around regulations that affect capital, profitability and long-term investing. Erratic stress test capital requirements and constant uncertainty around future regulations damage the banking system without making it safer."