Software companies’ earnings are being scrutinised across the board for what they say about the contested shape of the global economy – if software sales are the canary in the broader enterprise mine, everyone’s checking to see if the bird is still breathing in short and if so, just how much oxygen it’s getting.

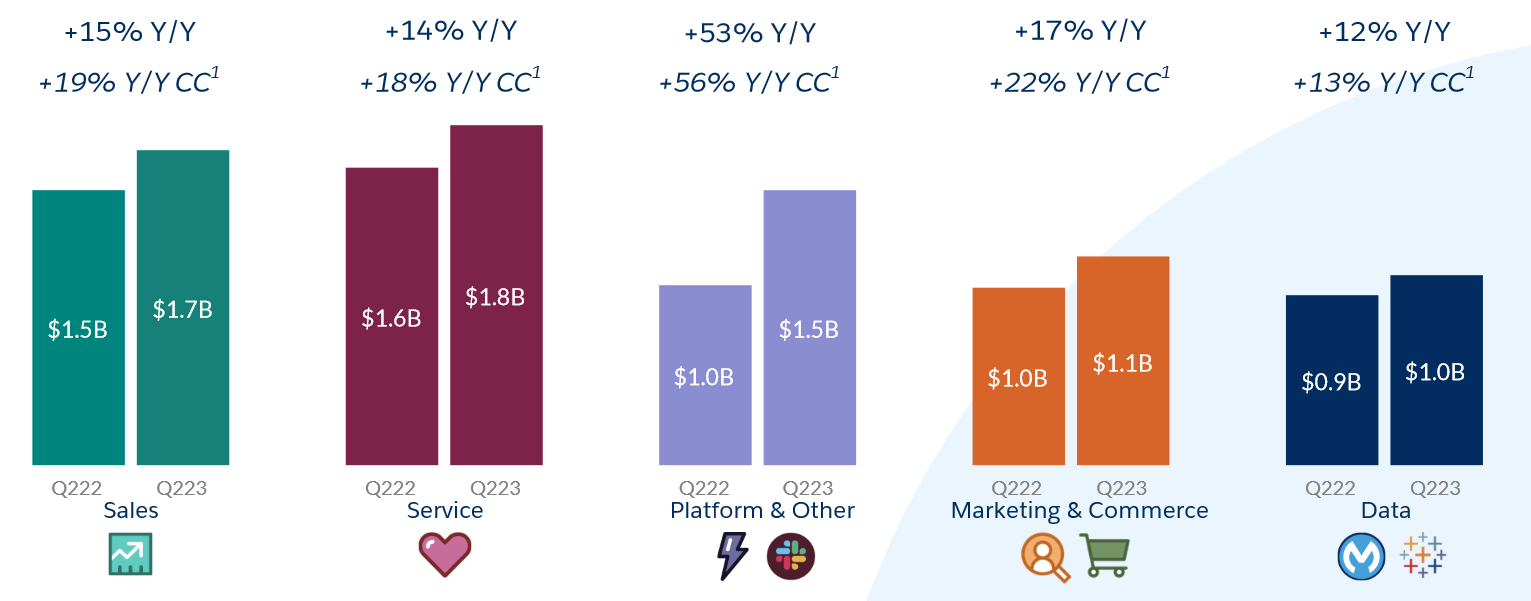

Salesforce’s earnings this week were a case in point. As canaries go, the company is a big one, selling $7.7 billion of software and services over its fiscal Q2, 2023 across its traditional CRM offering, vertical-focussed clouds and via the many companies it has subsumed up in recent years like MuleSoft, Tableau and Slack.

Sales clearly held up, but are “slowing in our create and close, Slack self-serve and SMB businesses, which tend to be leading macro indicators” as CFO Amy Weaver put it, adding: “Geographically, this behaviour was most pronounced in North America and major European markets, while Japan was relatively more resilient.

“Retail, consumer goods and communications and media were the most impacted, while high tech, energy and financial services stayed more consistent during the quarter. And from a product perspective, commerce and marketing saw more pronounced decelerations, while sales and service remains strong” she added.

(An aside: The company noted that it saw $720 million of Slack subscription and support revenues in the first half as Slack outperformed expectations. Seven of its top 10 deals in the quarter included Slack and the number of customers spending greater than $100,000 with Slack, grew by more than 40% year-over-year.)

Get yourself following The Stack on LinkedIn

Salesforce serves 90% of the Fortune 500 and CEO Marc Benioff said that from his regular conversations with industry leaders, one thing was clear: “We’re in a more measured buying environment. Executive teams are scrutinizing all purchasing decisions, and we are seeing some deals take longer to close. I personally met with over 100 CEOs this quarter in my travels… and digital transformation remains their top priority. But the focus of the conversation has shifted meaningfully towards productivity, efficiency and time to value.”

He added: “Everyone has got a slightly different answer [on where the global economy is heading].

"But what we do know and what I think everyone will agree on is that digital transformation remains the number one priority for CEOs and that every digital transformation begins and ends with the customer…”

Pressed for more detail on how sales cycles and software buying priorities are changing, co-CEO Bret Taylor said on the Q3 earnings call: “I think what you’re seeing is an increased focus on, I say, three things.

“One is time to value. The other is ensuring that these projects drive cost savings in addition to customer satisfaction and top line growth. And then the third is reducing complexity and vendor consolidation. Some of the stories I mentioned like Uber Eats, I think, are great examples because it’s really about how do you put up things like digital service technology, whether it’s chatbots or self-service, to really take out cost and make these projects pay for themselves as opposed to having protracted multiyear implementations."