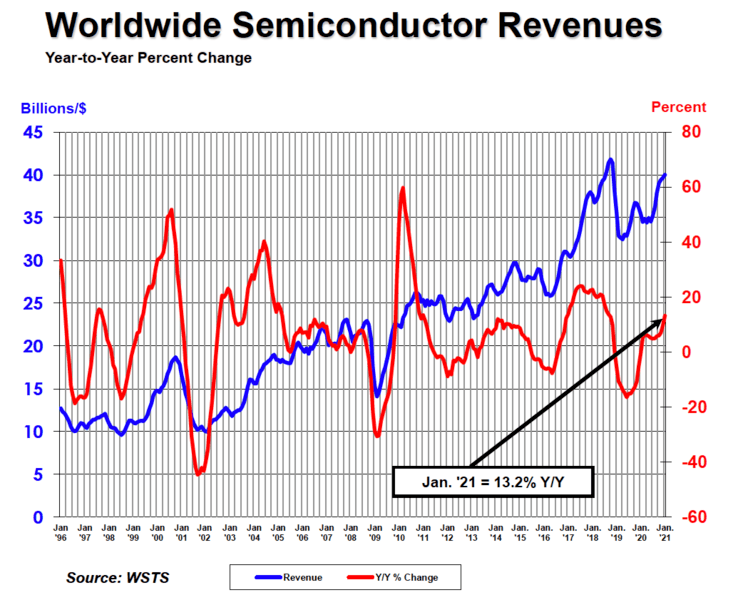

Global semiconductor industry sales hit $40 billion in January 2021, an increase of 13.2% over the January 2020 total of $35.3 billion, according to new figures from the Semiconductor Industry Association (SIA), which represents 98% of the U.S. semiconductor industry by revenue

“Global semiconductor sales got off to a strong start in 2021, increasing both year-to-year and month-to-month in January,” said John Neuffer, SIA's CEO. “Global semiconductor production is on the rise to meet increasing demand and ease the ongoing chip shortage affecting the auto sector and others.”

Sales increased across all markets: APAC (16%), Americas (15.4%), China (12.4%), Japan (9.6%), Europe (6.4%).

The figures come amid a semiconductor shortage across across the automotive and consumer industries, as demand soared for computers and peripherals during the lockdown even as the industry recovered from production interruptions caused by the early outbreak of the pandemic. The subsequent market tightness has turned industry and policy maker eyes firmly on the resilience and availability of semiconductor supply chains.

On February 24, US President Joe Biden announced a 100-day review of supply chains for semiconductors; key minerals and rare earths; pharmaceuticals and their ingredients; and advanced batteries.

Biden said: "We need to make sure these supply chains are secure and reliable. I’m directing senior officials in my administration to work with industrial leaders to identify solutions to this semiconductor shortfall and work very hard with the House and Senate... we’re reaching out to our allies, semiconductor companies, and others in the supply chain to ramp up production to help us resolve the bottlenecks we face now."

He added: "In some cases, building resilience will mean increasing our production of certain types of elements here at home. In others, it’ll mean working more closely with our trusted friends and partners, nations that share our values, so that our supply chains can’t be used against us as leverage. It will mean identifying and building surge capacity that can quickly be turned into and ramped up production in times of emergency. And it will mean investing in R&D, like we did in the ’60s, to ensure long-term competitiveness in our manufacturing base."

Earlier this month meanwhile chipmaker Micron updated its quarterly guidance as demand showed no sign of slowing. The memory specialist adjusted revenue expectations up from the $5.6-6.0 billion range to $6.2-$6.25 billion. Intel recently capped a record year with Q4 revenue of $20 billion, exceeding October guidance by $2.6 billion, while AMD saw record annual revenue of $9.76 billion in 2020, up 45% from 2019.