Financial Services

Citigroup spent the equivalent to some $50 million on technology every single working day over the past quarter..

Worldpay -- "a dozen payment M&A deals in a trenchcoat" -- will find a new home in the warm embrace of private equity after investment failings.

"... a concept has been developed for a centralised solution that will provide firms with an automated classification answer."

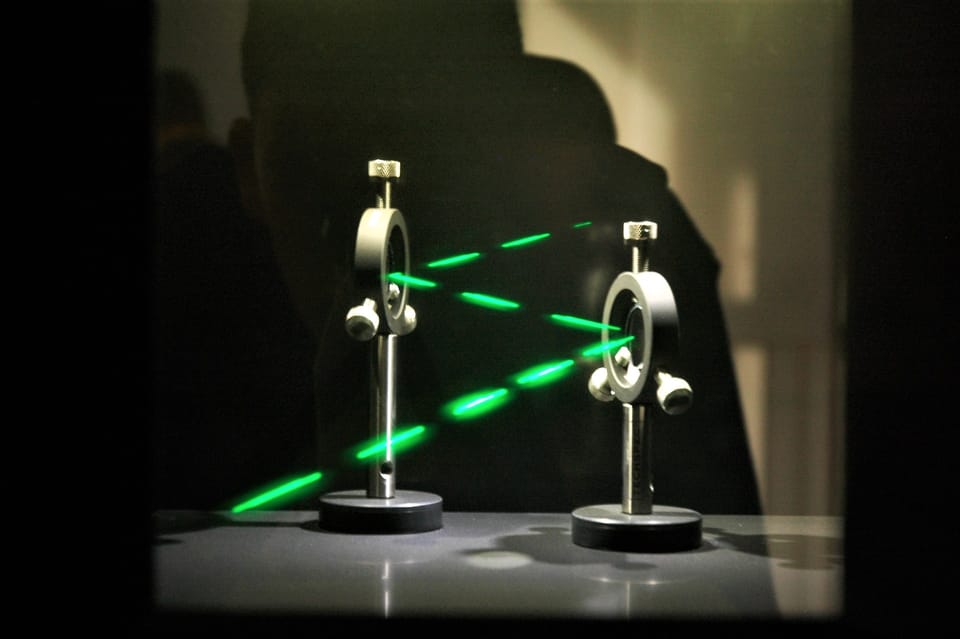

Dust off your math, review the literature with some strong coffee; envision a future fresh from a William Gibson novel...

From Citi's $1 billion "fat finger" and regulatory intervention driving a massive compliance overhaul, to major cloud migrations, spending continues at scale...

Treasury, risk, and collateral management, and regulatory and compliance software are more important than ever...

HMG makes a lot of payments: The Department for Work and Pensions alone makes 2.5 million+ daily that are worth £3.7 billion per week.

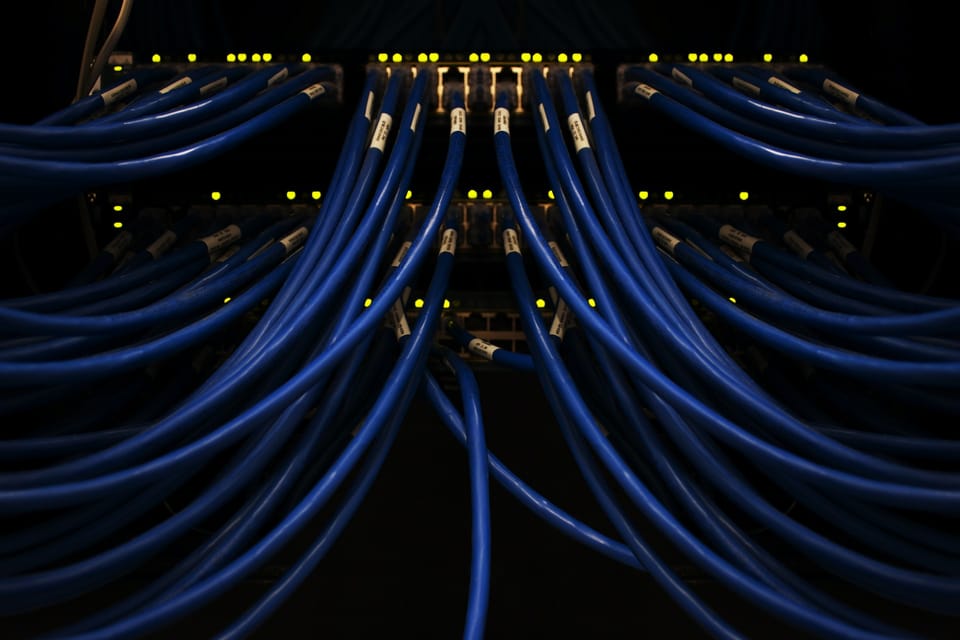

“We don’t have 200-person governance teams running around building PowerPoint; we have engineers actually understanding the data lineage…”

A major application modernisation programme continues through a mix of refactoring, SaaS replacement and legacy decommissioning – with 2,500 decommissioned since 2017...