Whether you work with technology as a CIO or developer, at a software provider, in government, defence, pharmaceuticals, or at a bank, we are all swimming in the waters of the same global macroeconomic environment; the conditions of local tributaries may vary, but the outlook for tech in 2023 will affect us all.

Few track the currents of these waters quite as closely as the investment banks and asset managers that help steer so much capital across them. As we consider the outlook for tech in 2023, The Stack reviewed the outlooks from some of this world's whales – Apollo, Blackrock, Citi, Credit Suisse, HSBC, ING, Lazard

The views in their 2023 investment playbooks and macroeconomic outlooks -- perhaps unsurprisingly -- vary differently, as did their focus on technology: Goldman Sachs, for example, makes just three mentions of tech, whilst Deutsche Bank mentions it 49 times and makes a central component of its outlook.

The outlook for tech in 2023

Much of 2023's outlook for all sectors depends on the pace and shape of inflation -- and economists at Apollo, an alternative asset manager with approximately $523 billion under management, make a critical point.

"Unfortunately, no constituency-- from central banks to chief economists -- has been able to forecast inflation accurately over the last 18 months" the asset manager's economists note frankly in their 2023 outlook.

"One of the main reasons for that disconnect seems to be that the root causes of this latest wave of price increases remain elusive. Why? Because we have been going through a series of unexpected and monumental exogenous shocks to the economy -- the Covid pandemic, unprecedented monetary stimulus, the war in Ukraine. These developments have flummoxed even the most finely tuned forecasting models."

BlackRock's view: Equity valuations don’t yet reflect the damage...

BlackRock, which had $7.9 trillion in assets under management (AUM) during its last quarter, has strikingly little to say about tech in its 2023 outlook [pdf]: The 8,900-word report mentions “technology” just five times, mostly in relation to clean energy. More broadly its economists take one of the bleakest view of the economic outlook.

Central bankers, they say, “are deliberately causing recessions by overtightening policy to try to rein in inflation” and they “won’t ride to the rescue when growth slows… contrary to what investors have come to expect.”

Get The Stack's newsletter on LinkedIn with just one click

“What matters most, we think, is how much of the economic damage is already reflected in market pricing" and (bad news for some) "equity valuations don’t yet reflect the damage ahead, in our view," its economists think.

Geopolitically, meanwhile, BlackRock takes the view that this is “the most fraught global environment since World War Two… We see geopolitical cooperation and globalization evolving into a fragmented world with competing blocs. That comes at the cost of economic efficiency. Sourcing more locally may be costlier for firms, and we could also see fresh mismatches in supply and demand as resources are reallocated," however infrastructure may be one bright spot, its economists suggest, saying it "has the potential to benefit from increased demand for capital over the long term, powered by structural trends such as the energy crunch and digitalization."

Citi sees an "unstoppable force of digitization"

Citi (which has $2.3 trillion in AUM) by contrast mentions “tech” 105 times in its report and is more bullish on the potential for an upturn, claiming: “The unstoppable trend of digitization is still in force and has far to go.”

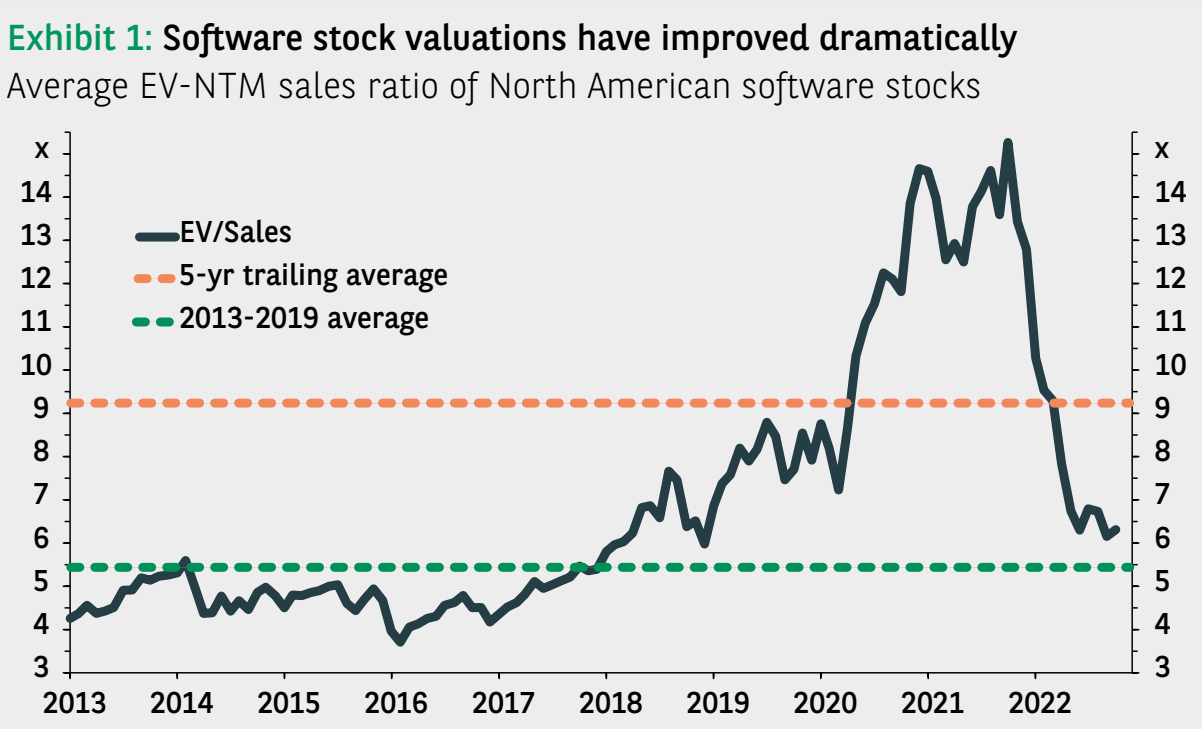

A tumble in technology equities in 2022 offers opportunities, it believes, suggesting that “current equity weakness may offer potential for building long-term exposure… we highlight semiconductors, robotics and automation and the metaverse, while reiterating our conviction in areas such as fintech and cybersecurity”.

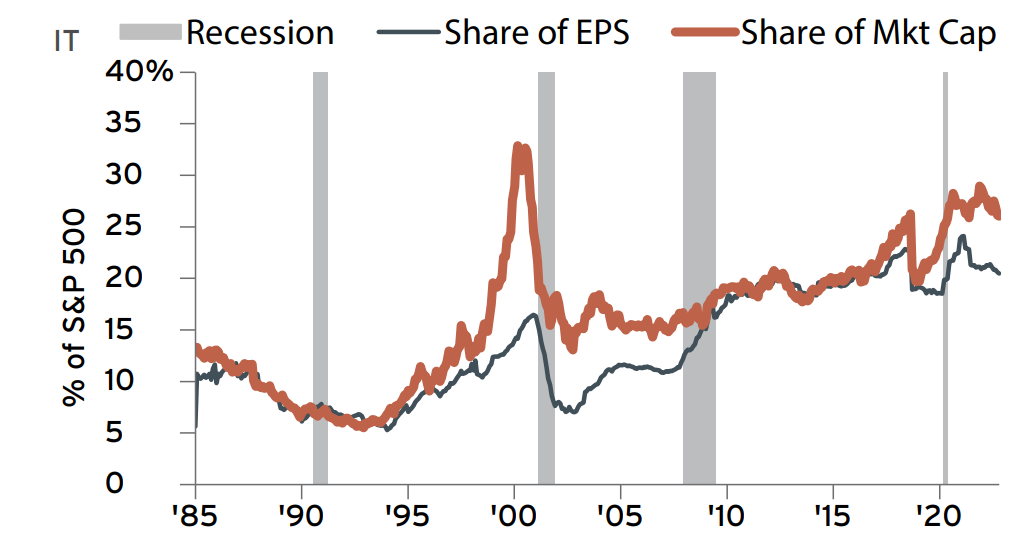

The bank suggests that this is most likely to play out in private markets: “IT deal value accounted for 31% of PE [private equity] deal activity in the third quarter of 2022, near the highest level ever. Technology is now a core focus for many buyout managers, given the sector’s growth prospects and today’s lower valuations… Capital still flowed into the sector.” (Some 1,239 the deals worth $128 billion closed globally during 2022 as of Q3).

A key focus for Citi, like many investment banks as they look ahead to 2023, is the consequences of a longer term decoupling between China and the US: Citi sees “a lasting technology trade war” and emphasises that “we expect China to double down on its drive for self-reliance on trade war fears, technology decoupling and ‘just-in-case’ supply chain risks” – it emphasises that “bifurcating technology blocs, duplicate supply chains and diminished cooperation are less economically efficient than a globalized system” but may be here to stay.

Deutsche Bank has stronger views on the outlook for tech in 2023

Deutsche Bank also has more to say on the outlook for tech in 2023. In fact, with 49 mentions in its 49-page report, it's in mind, as it were, on every page. Its view is, at heart, simple: "The importance of technology has been underlined by the global shortage of skilled labour and the need to make more efficient use of resources.

"In the long term, increased productivity will be needed to ensure stronger economic growth. Innovative technologies are the key to this – and are thus the guarantors of the future 'wealth of nations'".

Its broader economic view is more bullish too and built on three pillars. Succinctly and verbatim:

- "Mild U.S. and European recessions in the first half of 2023; growth then picks up

- "China to register significantly more dynamic growth in the year ahead

- "Innovative technologies to form the basis for stronger long-term economic growth

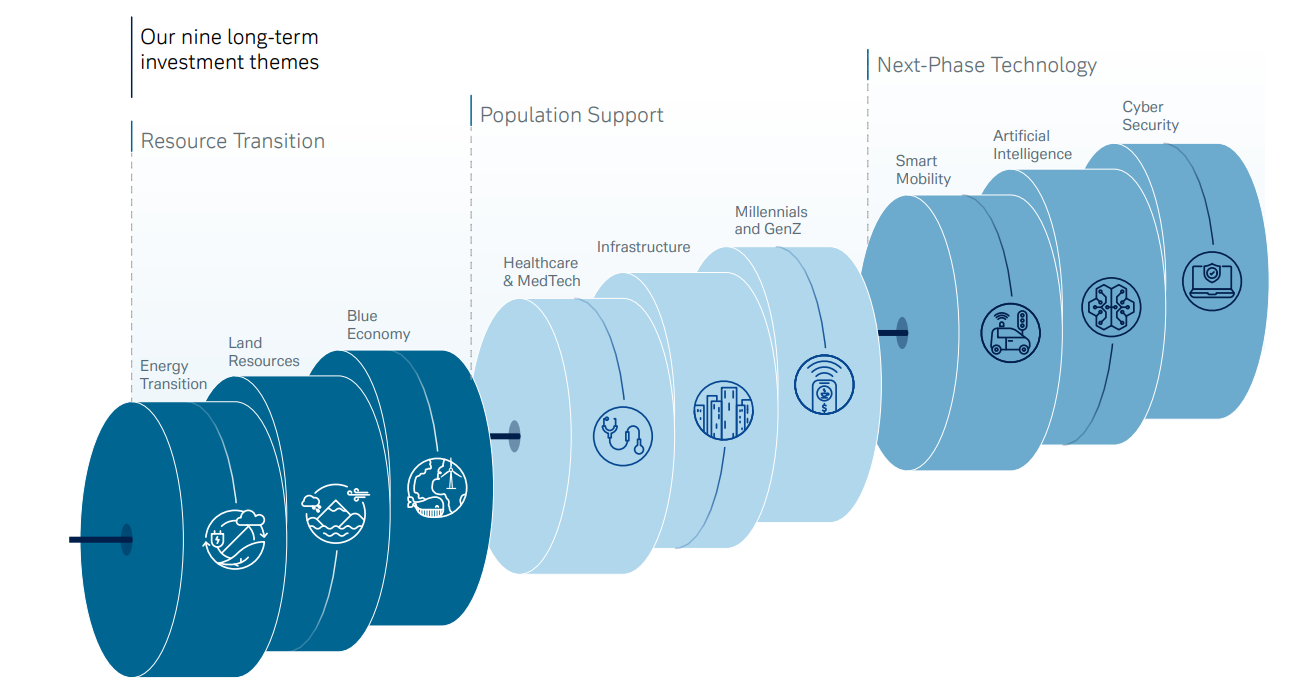

Deutsche Bank groups its long-term investment themes (LTIT) into three broad areas -- "Resource transition, Population support, and Next-phase technology" -- and technology runs across all of them. In healthcare, for example, the investment bank notes, "biotechnology and information technology are combining to offer new market opportunities, e.g. in the form of telemedicine, remote monitoring, med-tech or artificial intelligence."

The fact that "AI (and associated data training) is already getting much cheaper – for example, training costs for image classification systems have fallen by over 60% since 2018 --" means that "interest in the sector overall is likely to increase even further as deep AI (...with less dependence on human intervention) comes close."

Fidelity: "No reason for undue pessimism"

Fidelity, meanwhile (which has $9.6 trillion under administration), makes just one mention of tech and has a cautious outlook more broadly on the economy and financial markets, saying: "The deteriorating environment is not reflected in earnings forecasts or valuations, implying there could be further downside to come. We expect volatility to remain high, and sentiment is low enough that sharp risk-on bounces will be likely, if short-lived.

"Earnings estimates for 2022 have gradually declined as the year has progressed, but estimates for 2023 have barely budged, an anomaly given the challenging outlook for the coming year."

But its analysts add: "Over a longer time horizon, we see no reason for undue pessimism. Economies will survive this particular bout of challenges and doubtless emerge stronger when they do."