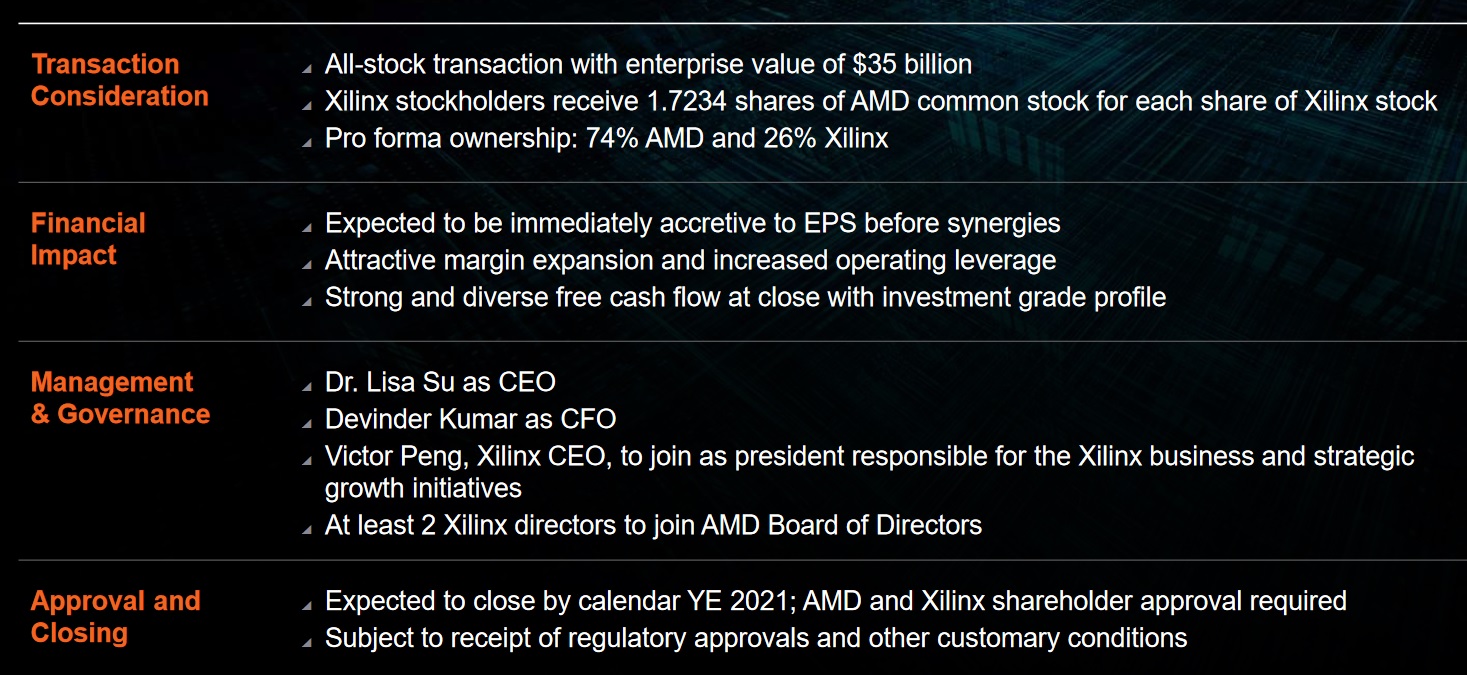

AMD and Xilinx's shareholders have approved AMD's proposed $35 billion all-share takeover -- moving the companies a step closer to creating a unified semiconductor heavyweight with an expansive portfolio spanning CPUs, GPUs, FPGAs (Field Programmable Gate Arrays), and Adaptive SOCs.

AMD aims to generate some $300 million worth of annual cost savings within 18 months of closing. Under the deal, AMD shareholders will own 74% of the post-merger company; Xilinx shareholders the other 26%. The deal, first announced in Oct. 2020, will create a silicon pioneer with a combined 13,000 engineers, high-quality 2.5/3D die stacking capabilities, packaging, chiplet and interconnect technology, as well as extensive experience across a wide range of domain-specific architectures and strong customer cross-selling opportunities.

AMD CEO Dr Lisa Su said she was "so excited" by the news. Su, who has led a remarkable renaissance at AMD in recent years, said she looked forward working with Xilinx to "push the envelope on high-performance computing", adding in a release that "the acquisition of Xilinx marks the next leg in our journey to make AMD the strategic partner of choice for the largest and most important technology companies in the world."

AMD Xilinx takeover: What does Xilinx do?

Xilinx specialises in highly flexible semiconductors that are based around a matrix of configurable logic blocks connected via programmable interconnects. As Moore's Law slows, Xilinx believes that FPGAs (along with its broader portfolio of programmable silicon) will be crucial to gaining performance increases for compute across the board: i.e. machine learning workloads for financial companies, genomics, video and image processing.

(Speaking at a Churchill Club event attended by The Stack's founder Ed Targett in late 2019, CEO Victor Peng painted a picture of a "silicon renaissance" driven by emerging chip architectures: "When I say architectures I mean the technology as a whole: at the technology level in transistor, device, packaging, advanced packaging, integration, micro-architecture and instruction set architecture and even architecture at the scale of entire data centres... There’s going to be computing in the CPU, in the storage, in the network adapter, even in a switch.)

https://twitter.com/LisaSu/status/1379839097049542660

Together, the combined company will have the ability to "capitalize on opportunities spanning some of the industry’s most important growth segments, including data centers, gaming, PCs, communications, automotive, industrial, aerospace and defense", the two said in a joint release on April 7.

The two believe that the deal will result in strong synergies between AMD traditional strengths in PC and gaming (along with an increasingly robust position in the data centre) with Xilinx’s established relationships and FPGA and SmartNIC sales in communications infrastructure, industrial, automotive, aerospace and defense and other key verticals: the deal expands AMD's total addressable market to an estimated $110 billion.

“The Xilinx team is one of the strongest in the industry and we are thrilled to be joining AMD,” said Xilinx's Peng: “Our shared cultures of innovation, excellence and collaboration will enable us to accelerate growth in the data center and pursue a broader customer base across more markets as a combined company.”