SPONSORED -- Few things are more important for the success of global commerce than cross-border payments. The vast majority of these flow through correspondent banks (a bank in one country that is connected with a bank or financial institution in another country), creating what the Bank of International Settlements (BIS) describes as “critical linkages that… underpin global trade, finance and remittances.”

Yet bank de-risking – an anodyne term for what often amounts to the brusque termination of a business relationship – led by Anti-Money Laundering (AML) and Countering Terrorist Financing (CTF) compliance risks, as well as pressure on margins – is driving fundamental change in the correspondent banking world. This is making it ever harder for smaller banks and other non-bank financial institutions (NBFIs) to serve their clients.

De-risking means many firms face the possibility of their bank withdrawing from the relationship outright. It’s nothing personal; just a strict rules-based system deciding against a certain vertical, asset class, or region.

In the wake of the 2008 financial crisis, global banks faced a backdrop of lower profitability, dampened risk appetite and tighter regulation and supervision and took the opportunity to heavily de-risk as a result. HSBC’s criminal prosecution for money laundering in 2012 heightened the trend.

That’s triggered higher costs for Tier 2 and 3 Banks and NBFIs, as well as inclusion issues.

The cost of adding additional controls to certain geographies or business types means many banks have de-risked them, compounding financial exclusion for vulnerable communities and businesses.

> Download Banking Circle's Whitepaper on De-Risking <

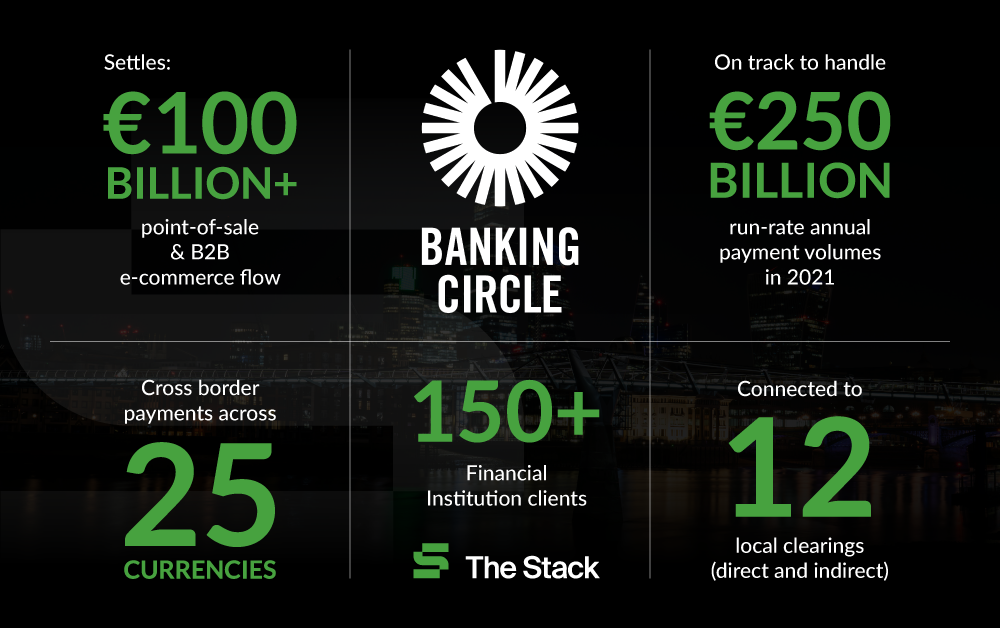

There have been other side effects. As a new survey of 700 global Cash Managers and Corporate Treasurers – conducted by “super correspondent bank” Banking Circle, a Payments Bank – found 77% of respondents had seen a rise in the number of correspondent banking partners over the past ten years.

More relationships mean more internal resources are required to manage the banking partnerships, and costs are incurred for each relationship, increasing the cost to customers and depleting profitability as 65% of respondents to the survey agreed. Many urgently need a new solution for their customers. (These multiple relationships aren’t just to mitigate the risk of de-risking, but sometimes simply to access multiple currency services… A British bank for sterling, an American one for dollars, a European one for Euros.)

"It’s time to think about finding a better partner": That’s according to Banking Circle’s Mitch Trehan: the Payments Bank’s UK Head of Compliance and Money Laundering Reporting Officer – whose resume includes extensive experience in compliance at Citi, Barclays and as a Global Head of Compliance at several fintechs.

Speaking with The Stack’s founder Ed Targett, he noted: “With everything banks do there’s a risk. De- risking is ultimately banks looking at their client base and deciding ‘do we like supporting these clients?’

"There’s nuances within that: it can be a case of ‘we just don't have appetite for this industry’. Or ‘we don't have appetite to let them do certain geographies, or certain sub-industries’, or ‘we have appetite for the industry, but you are outside of our appetite’. Then there's a there's a cost-to-serve model. Banks aren’t charities. If they're going to put more controls towards a client or industry to make sure it's all okay, that costs more.”

“What makes us unique is that serving payment services firms and other banks isn’t an additional vertical that we do, it is what we do. If we abandoned them, we wouldn’t have a business.”Mitch Trehan, Banking Circle

HSBC was fined $1.9 billion in 2012 for “failing to maintain an effective anti-money laundering program and to conduct appropriate due diligence on its foreign correspondent account holders” (as the Department of Justice put it). Also adding that the bank had “facilitated the laundering of at least $881 million in drug proceeds through the US financial system”, it triggered a wave of de-risking that left a lot of collateral damage along the way.

As Trehan states: “That really started making people pay attention.

“In 2012 HSBC started looking at the industries that were posing the highest risks for them and de-risking a lot of those. In 2013, Barclays did the same thing with regard to the fintech and payment services industries; exiting hundreds of their clients. An unintended consequence of that was that in other banks, all the leaders and risk owners thought ‘we need to close our doors and figure out what’s happening; we don’t want to be the last one carrying unknown risk here’. Almost everyone closed their doors; it started a real chain reaction. Payment services firms”, he adds, “bore the biggest brunt of that.” (He knows; he was at Barclays at the time…).

Several years later, the introduction of the second payment services directive, or PSD2, in January 2018, started to impact the industry. (PSD2’s Article 36 calls on European member states to “ensure that payment institutions have access to credit institutions’ payment accounts services on an objective, non-discriminatory and proportionate basis”, adding that “such access shall be sufficiently extensive as to allow payment institutions to provide payment services in an unhindered and efficient manner”).

Correspondent banking costs have soared

As Trehan notes: “That did two things. It made some banks just shut their doors completely and say ‘if we’re not supporting this industry at all, then this doesn’t apply to us’. The banks that still wanted to play in this space meanwhile really start focusing on putting controls in place, which has a cost that is passed to customers. Banks and NBFIs that need correspondent banking services have also been investing in their compliance and AML regimes, rooting out financial crime and making themselves more attractive prospective customers for Correspondent Banks. But that’s got expensive for them and they still live with the fear of being de-risked.

"Another challenge is that many banks providing correspondent banking services are still running on legacy technological stacks and with organisational approaches built for an earlier age." (Pre-financial crisis, he adds, compliance wasn't even really a massive department for many banks, just a subset of legal. Some of them are struggling to evolve, technologically, operationally, and culturally…)

As Trehan puts it to The Stack however: “At Banking Circle that’s where we started: we’re technology-first and built with AML/CTF controls at our heart. And what makes us unique is that serving payment services firms and other banks isn’t an additional vertical that we do; it is what we do. This is our bread and butter. So whereas another bank might one day decide ‘too much risk for us, we're going to exit or de-risk this industry’ we would never do that. If we did that we’d shut down! That's our only industry: it’s who we were built to serve.”

Payments firms need something to change: 80% of respondents to the survey said that their correspondent banking costs have increased by around 80%, while 75% said they believe that they have lost customers that they were serving before due to the lack of access to fairly priced correspondent banking. (Banks charge a de minimis threshold; if you’re a smaller bank or NBFI and only have a certain amount of flow, or payments to make and that threshold is having to be paid at numerous banks, your cost base is going to go up…)

Virtual IBANs and other innovations are helping improve visibility

Technology is helping to improve this situation. Using “virtual IBANs” for example that can be digitally spun up en masse to allow easy allocation to underlying customers, or to internal departments, Banking Circle can link up to 25 currencies to each virtual IBAN, allowing local settlement and payment capability, such as Faster Payments Service and SEPA, with full reconciliation reporting available on the Banking Circle web platform, the Banking Circle API (which also enables FX and payment capability), and SWIFT. But it gets better…

As Trehan notes: “Our onboarding processes, whilst slick and efficient, is actually very in depth. One of the things we do is test the controls of our clients, which means they don't get through the door until we know they're good enough. That means they’re less likely to have surprises down the line. And technology like our virtual IBAN and the Artificial Intelligence associated with that gives insight that further avoids de-risking.”

It does this by giving hugely improved visibility into the behaviour of underlying customers. “Most banks give their payment company’s account to the business they’re dealing with: you get a million payments in and a million payments out, and you can't map what's what. What we do is give our clients virtual IBAN sub-account numbers spun up for each of their underlying clients: so anytime something comes in, they know exactly who it's for; and for reconciliation, that makes things really easy. For us, we can associate what’s coming with each of the underlying customers. That means our AI can do analysis not just on the payments client, but the underlying individual customers of that client. That allows us to ask questions of our client firm without having to de-risk or anything else; sometimes it helps them find things that they need to look at.

“And rather than having a scenario in which you are de-risking an entire client, they can then target those people beneath them causing concern: that really works well when you work closely with your customers.”

It’s a modern approach, built on a cutting edge but battle-tested technology stack that means a world of higher costs and unsustainable correspondent banking resource requirements – that has hit so many smaller financial institutions and their customers over the years – could be a thing of the past. And that’s good for everyone’s business, good for tackling financial crime, and great for turning the tide of unnecessary financial exclusion.