Tech providers are becoming “competitively and continuously focused on sustainability initiatives” claims Gartner as “organisations with real green targets have realised the influence their choice of vendor has over their own objectives” and look for “demonstrable sustainability goals and timelines, not false promises.”

The research house said in a new report that environmental and sustainability initiatives are now considered a ‘top business’ priority and that by 2026, 70% of technology sourcing, procurement and vendor management (SPVM) leaders will have environmental-sustainability-aligned performance objectives for their functions.

See also: Expect to hear a lot more about XBRL. Here’s why

The report comes as The Stack hears anecdotally that several major IT buyers have swapped key tech providers over their failure to credibly report sustainability data, as they look to tackle Scope 3 or supply chain emissions.

(This has has triggered a flurry of activity among software providers looking to help organisations track sustainability reporting data via APIs to ERP and other software systems, as well as deal and funding activity in recent years: Blackstone’s acquisition of sustainability software Sphera for $1.4 billion in 2021, IBM move for environmental data startup Envizi, or Workday’s investment in pulsESG are all cases in point.)

Join peers following The Stack on LinkedIn

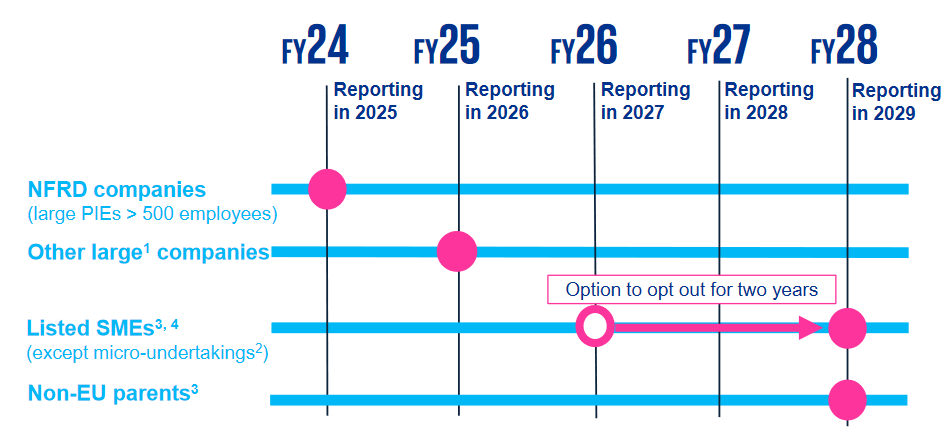

The report comes as the European Commission aims to finalise work on its first set of European Sustainability Reporting Standards (ESRS) by June 2023. These lay out rules on corporate sustainability disclosures as part of the Corporate Sustainability Reporting Directive (CSRD), which is scheduled to enter into force in 2024.

(The ESRS will apply initially to all large and most listed EU companies; large subsidiaries of non-EU parents; and non-EU companies with a turnover in the EU of more than €150 million and will require companies to report on how their activities and value chain affect the environment and people, as well as how sustainability matters affect their cash flows, financial position and broader financial performance.)

The ESRSs are expansive. As the European Central Bank (ECB) put it in an opinion this week, they are “capable of substantially improving the quantity, quality, reliability and comparability of corporate sustainability disclosures”, with the ECB welcoming the “reliance on quantitative metrics, the requirement to disclose detailed transition plans in line with the 1.5°C goal of the Paris Agreement, the inclusion of Scope 1, 2 and 3 GHG emissions… [and] quantitative estimates of exposures to physical and transition risks... Given its novelty, reporting in accordance with the ESRS might be challenging for some preparers, especially in the first years of implementation and particularly for entities not previously subject to sustainability reporting” the ECB emphasised."