Fathom was SME winner of The Stack‘s 2021 Tech for Good awards

As financial exposure to the impact of climate change increases, climate risk has reached the top of the financial agenda for boards, investors, lenders, asset managers and owners. Yet the technology to measure and report on this has only just become possible, with some of the most compelling insights demonstrating the impact of climate change on flood hazard risk, writes Karena Vaughan, ESG and Climate Risk, Fathom

Whilst flooding is a natural phenomenon, there is little doubt that human-caused climate change is making flooding more severe and widespread. Climate change is causing sea levels to rise and more extreme weather events, such as intense storms, are becoming more common. This leads to greater flooding of coastal regions, as well as increased runoff from heavy rainfall further inland.

Climate change also affects the frequency and magnitude of floods in other ways. Warmer air holds more moisture which can lead to heavier precipitation, and longer periods of warm weather can cause snow to melt faster and therefore increase river levels. In addition, higher temperatures mean that soils in many areas are less able to absorb water and so runoff grows, leading to more flooding.

With climate change set to increase the intensity and frequency of floods in the future, investors, asset owners and managers must take action to better understand, measure and mitigate their exposure to flood risk.

This includes assessing the potential impacts of climate change on individual assets, and at a portfolio level, and preparing for greater levels of disruption in the future.

Flood risk: Making informed decisions

By understanding how climate change is increasing exposure to flood risk, informed decisions can be taken to protect investments, whilst also helping to protect communities and the environment.

To understand portfolio risk from flooding, investors and lenders should consider taking a holistic view of exposure by considering all the properties and assets in their portfolio. This requires an assessment of both direct (asset-level) and indirect (outlying) flood risk.

For more accurate pricing of assets, investors should make sure that the potential for climate-induced flooding is taken into consideration. This means having a clear understanding of the risk posed by floods and the likelihood of their occurrence in specific areas, as well as the costs associated with managing such events.

See also: AI has helped simulate the earth’s surface to a new level of detail

Meanwhile, for pre-investment due diligence, investors need to understand the potential impacts of floods on specific assets and their environment. This includes assessing the physical, economic, legal and reputational risks posed by flooding. The aim is to identify any areas that may be particularly vulnerable to climate-induced flooding and then design appropriate strategies to reduce exposure. As the surge in investment in hard assets continues, this due diligence also provides boards with better insights into where assets should be located and how they should be designed, to reduce exposure to climate hazards and avoid costly remediation work.

Transparency in reporting is also a factor that cannot be ignored, both to meet growing regulatory requirements for better risk management, and to avoid accusations of greenwashing.

The financial implications

Climate change coupled with urban development is making flooding more frequent and severe, as the warmer atmosphere holds greater quantities of water. It also encourages compounded events such as cyclonic storms and drought. As a result, flood prevention and damage redress are costing businesses more – sometimes many billions of dollars more. Meanwhile, changing flood patterns are impacting long-term capital investment decisions. Today’s attractive greenfield site may be tomorrow’s floodplain.

From coarse to granular

Historically it has been frustratingly difficult to quantify the climate-change-driven intensification of floods caused by persistent rainfall, overtopped river banks, and coastal surges (pluvial, fluvial, and coastal flooding respectively). It was well known that the climate models used to forecast the impact of global warming operate at very low levels of resolution to predict change over decades.

But floods happen incredibly quickly and are so localised that neighbours may experience radically different impacts of the same event. Bridging the gap to marry climate change models with flood maps is therefore an extraordinarily difficult challenge.

Uncertainty is another major barrier. All climate models come with warnings about their inherent degree of uncertainty. Hydrologic and sea-level maps introduce a second layer of built-in uncertainty. Any forward-looking flood map will look to the past to determine its warming level baseline, so the accuracy of the historical experience provides a third source of uncertainty. Finally, climate change itself is uncertain, so its future variability will inevitably impact projections.

Creating a useful map of the impact of climate change on floods requires a transformation from the coarse to the granular, and the uncertain to be shifted, as far as possible, into the realm of the likely. For any flood map to deliver credible outputs, it must allow for multiple time horizons and emissions scenarios. It must apply to all three types of flood at a very local scale, but provide global coverage (so as to be internationally relevant). It must be completely transparent, high resolution, and based on the most current scientific knowledge and techniques. And to deliver all of these, it will require a gigantic amount of computational power.

Enter Fathom’s Global Flood Hazard Map and Climate Dynamics framework.

Until now, the tools and technologies to quickly and easily assess climate risk were primitive and difficult to use. There was a lack of temporal and spatial datasets, issues with data standardisation and other complex problems that had to be solved.

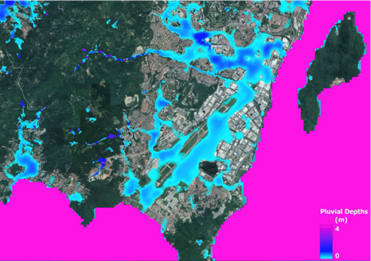

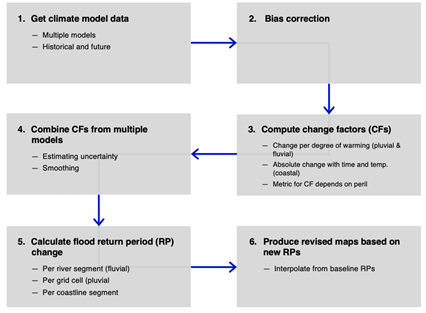

Fathom’s team of scientists has developed a flexible climate-change flood-modelling framework that allows future changes in climate to be applied to flood-model outputs, Climate Dynamics. This groundbreaking framework is capable of producing climate-conditioned hazard data for fluvial, pluvial, and coastal flooding for any future emissions and warming level scenario anywhere in the world, to the year 2100.

Using this framework, risk professionals can access a physically consistent view of the impact of climate change on flooding everywhere around the globe with an actionable degree of confidence, and Fathom is not keeping its development process under wraps.

The development of this framework has enabled Fathom to build flood maps for a flexible range of time periods, warming levels, and emissions scenarios, at the unprecedented resolution of one arcsecond, or 1/3600th of a degree of longitude - approximately 30 meters.. It provides an unparalleled understanding of the global flood-related impacts of climate change based on a unique, scientific approach.

What does this mean for boards, investors, lenders, asset managers and owners?

Climate change is not just an environmental issue, it’s a financial one, and climate risk is financial risk, with hard-hitting implications for both businesses and financial markets. More and better climate risk data is available today than ever before, but it’s not just about the data. We need to translate that data into powerful risk intelligence, to apply scenarios and build models that enable informed financial decisions.