SWIFT is building a new platform that will let it run cutting edge analytics on over 10 billion transactions a year using a containerised on-premises infrastructure, federated learning models and unique software-defined memory to help it utilise its existing hardware stack, says Chief Innovation Officer Tom Zschach.

The platform will make use of SWIFT’s existing IT infrastructure but be microservices-based, so in future it could in theory be taken to any public or private cloud environment. It will, when live, in theory help deliver more sophisticated tools than legacy rules-based detection systems, to help SWIFT tackle financial crime.

See: Goldman Sachs puts “Platform Services” at heart of restructuring

SWIFT hopes to use federated learning (where algorithms are pushed out to members to be trained on their data, rather than having all data hosted and training happen centrally), saying that the “upside of shared intelligence and a federated anomaly detection model could be significant – elevated risk management, greater operational efficiency, reduced total cost of ownership, minimized customer friction, and boosted organizational growth.”

SWIFT is a member-owned and controlled cooperative and global financial infrastructure. It spans 200+ countries and territories, and services more than 11,000 institutions. Its members send over 40 million financial messages across its network daily. SWIFT’s Chief Innovation Officer Tom Zschach, who is leading development of the platform, has been with the organisation since January 2020 and sits within SWIFT's Products group. (As he puts it to The Stack, the fact that innovation sits within Product shows that “we don’t do ‘innovation theatre.’”)

Real-time financial crime detection services

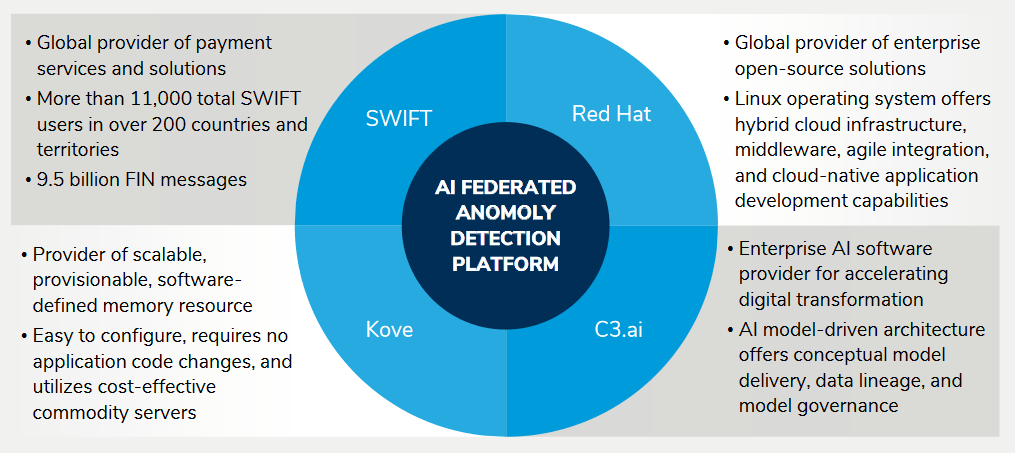

SWIFT announced plans for an “AI platform that will be future-ready, large-scale, and high performing” at the SIBOS 2022 conference. It is working with partners C3.ai, Kove, and Red Hat on the project.

For its maiden use case, SWIFT and Red Hat are building a model for anomaly detection in transactions. Other initiatives built on the platform may follow, if SWIFT's members want them. Tom Zschach told The Stack: “We have the first models developed and trained. The first step would be to apply an AI capability to an existing [SWIFT] product...”

Running AI on the data of a multi-member cooperative is no mean feat and there are a lot of stakeholders to win over (more on that below).

As a result “those launch dates haven't been agreed or approved” he confirms, though the “new digital state of the art platform [is] coming online this year in [its] early stages on a soft launch, and then in earnest in the early part of next year. Then in parallel”, he adds, “we're continuing to develop the next generation model for anomaly detection. We'll do that with our banks, using federated learning techniques, and the goal there is to develop the most accurate anomaly detection model for transaction processing in the world.”

SWIFT analytics Building the stack

Zschach has deep experience working with large-scale financial infrastructure. He was previously Chief Information Officer (CIO) at CLS Group, which settles over $6 trillion daily, and CIO at multinational clearing house LCH Group. (Prior to that he spent 20 years in several investment banks including BoA/Merrill Lynch as Head of Rate and Currencies Technology and at Barclays Capital as Managing Director in Technology.)

He’s taking a unique approach to the SWIFT analytics platform’s stack.

“We decided to take an on-prem approach” he explains. “All of the work we're going to be doing is going to be done inside of SWIFT," adding "we were doing that primarily because of the confidentiality of our data. In terms of business drivers, it needs to be performant and it needs to scale. SWIFT has tremendous scale today and tremendous engineering capabilities and [an] operational track record that' really superior.”

“We wanted to be low cost, we would want to actually utilise the hardware stack that we have in place in terms of compute and memory” he emphases, “because we want to try to minimise our carbon footprint.”

“So it's an on-prem approach and it’s a platform approach. All of our new platforms are based on microservices architectures and containers that'll be run in-house. By taking this approach, we have the option to take advantage of a public cloud or hybrid cloud, whenever we get ourselves comfortable with and we have the need to do that. So it's building it for the future. It's really anchored on three vendors to deliver the platform part of it. One is C3 AI which is the enterprise AI platform. The second one is Red Hat. The third is a unique product from Kove that provides software-defined memory. What that really means is that we're going to be able to train models, and monitor the network, really, without any computer, or hardware limitations.”

Join peers following The Stack on LinkedIn

(Kove lets users examine memory and CPU utilisation across the data centre. Its EMX software provides dynamic allocation of external memory from a group of what it calls XPDs – these are pooled memory that allows users to aggregate multiple Infiniband links and devices into one big virtual address space that can be dynamically partitioned. The company, widely used in financial services, can generate multi-terabyte per second bandwidth in a few racks of equipment and accelerate Sybase, Informix, Oracle, KDB+, McObject, ParAcell , Versant and other database technologies. nb it is neither an in-memory database nor cache, it pools existing "stranded" memory.)

Red Hat is the primary partner helping with the build. Kelly Switt, Senior Director, Global Edge and AI Development – describing her role modestly as a “orchestrator of talent” – says that Red Hat is acting as the “middle layer to make sure that everyone is successful across the stack and the customer is successful”.

That has included making engineering changes to Red Hat’s OpenShift platform “in order to make sure that we could run that distributed memory mesh as a actual service that was native to the container platform, or the work to make sure that C3 AI will actually operate in a clustered environment on OpenShift” she tells The Stack.

"It's a strong collaborative effort"

To SWIFT’s Chief Innovation Officer Tom Zschach, the organisation sits in a unique position when it comes to innovation: “As a cooperative and a not-for-profit that gives us certain advantages, in terms of having time to develop these things [without having to] have to hit a revenue number at the end of the quarter.

“We also have the ability, where people who might not partner with other commercial entities, will partner with us because we can actually build and focus on industry solutions together” he says.

How does former CIO Zschach work with other internal partners?

See: ING CTO: We’re shifting apps aggressively to private cloud

“Our tech platform team is heavily involved under CTO, Cheri [McGuire]” he says. “It’s a very strong collaboration with tech platform, with security; it's really a collaborative effort inside of the company, as well as a collaborative effort outside of the company. That's a big driver for what we do in Innovation, and where we sit in the industry that allows everyone to bring their expertise to these activities.”

The ultimate aim here is to be able to deliver new services. That’s where it does get complicated however.

As Zschach explains: “Every model has to be explainable. That's just been really consistent feedback from every single financial institution, every bank that we spoke to, if you can't explain why the model produces what it does, then it's really not usable, so we know that it needs to be auditable.

“It's not our data, we're trusted stewards of our data.”

"... that's not what we've been able to accomplish yet"

That makes his job uniquely challenging but also means that as a Chief Innovation Officer he really gets to work at the cutting edge of federated AI and of privacy-enhancing technologies (a term that can encompass anything from synthetic data to homomorphic encryption.) As he puts it: “We have very, very stringent data governance, data privacy, data security policies. In something like something like anomaly detection [we need to] build that feedback loop between us and a bank, for example, where, we can do that [train models/work with data] in a way that doesn't violate policies, and certainly doesn’t violate the law because in some cases it's illegal to share information like that [transactional data]. So all of this has to be done in a responsible way. The [first] goal isn't get the model out the door, the goal and the ambition is to do it in a way that keeps the community safe.”

In theory, his team believes, building high-performing federated anomaly detection model for the financial services industry like this would allow the creation of network analysis that could create a “network view” of customers, locations, accounts, transactions, and any other objects where data exists to uncover linkages among different parties, accounts, and events. Payment flows and other financial transactions could then be linked across common legal hierarchies or business groups, because, as SWIFT notes in a whitepaper “these connections are unknown or hidden and go undetected by legacy surveillance systems and human analysts.”

The CIO is tackling some potential hurdles to data sharing et al by taking a federated learning approach, whereby, as he puts it, “instead of bringing the data to the model, we're going to take the model and give that to our banks to train… they could cover customer segments that we don't cover… if you think about who we are, and the banks that we work with, by setting this up [in this way] we could not only preserve the privacy of the data but we can actually build a model that I don't think anybody else can do…”

If model training is being done in a federated manner that must throw up some huge auditability issues and transparency challenges around the explainability of the resulting algorithms, The Stack suggests.

Zschach agrees strikingly frankly: “That's what we need to work out, right? This only matters if we can build it in a responsible way and that includes explainability. This is why it sits in innovation, because that's the ambition, that’s not what we've been able to accomplish yet. But going back to collaboration with strategic tech partners, with fintechs, with banks, we're in a really optimal spot to try to figure this out and really solve an industry problem. It's not easy. But I think we have a really good chance of success!”

Think you can help? SWIFT would like to hear from you. Get in touch