ING’s Chief Technology Officer (CTO) Ron van Kemenade says the bank has saved upwards of €100 million in operational expenses (opex) in recent years by consolidating on private cloud – saying that 34% of all the applications worldwide at ING now run on private cloud and he hopes to get the figure to 70% by 2025.

Van Kemenade was speaking today (June 13) at ING’s investor day alongside Marnix van Stiphout, ING’s new Chief Operations Officer and Chief Transformation Officer. (ING separated operations from technology in April 2021 shortly before then-COO Roel Louwhoff, who held responsibility for both, left for Standard Chartered.)

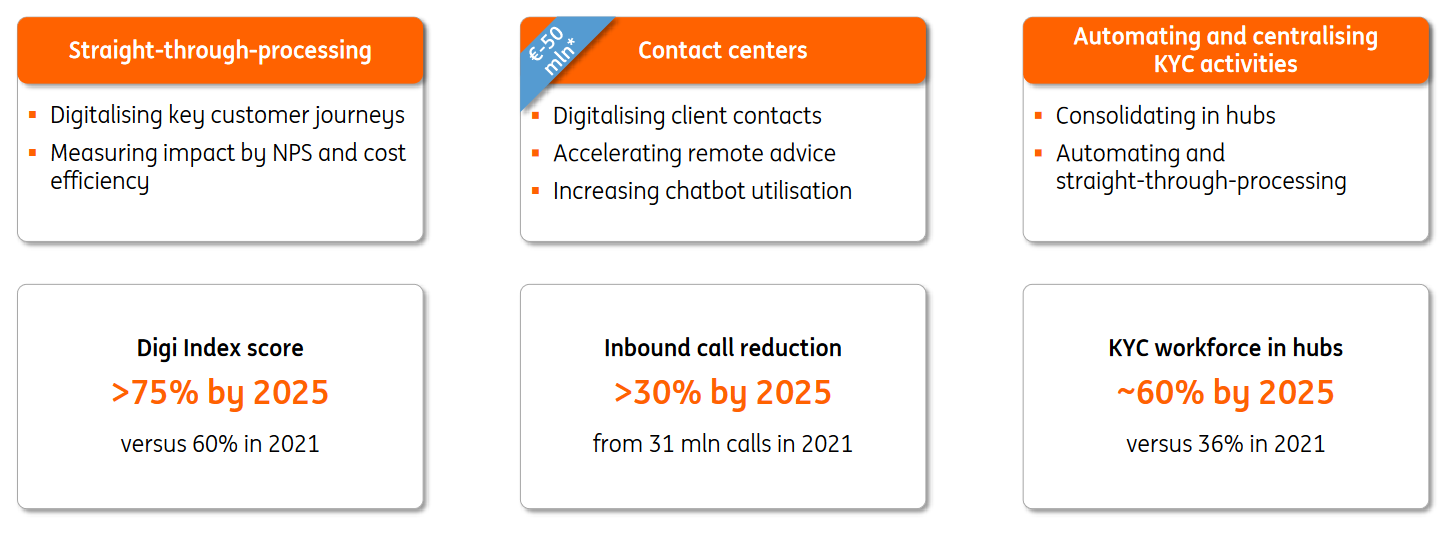

The bank's technology leaders during the event spelled out plans to focus on digitalising customer journeys, streamlining operations, reducing contact centre costs and automation. ING has been aggressively consolidating in recent years, for example exiting the retail banking markets in Austria, Czech Republic and France.

See also: Companies could save billions by ditching ‘Hotel California’ cloud for own infrastructure: VC

ING leaders also spelled out ongoing plans to improve KYC -- after reporting regulatory costs for Q1 2022 alone of an eye-watering €649 million (this is in part because the quarter captures annual charges including contributions to the European Single Resolution Fund (SRF) and the Belgian deposit guarantee scheme...)

ING CEO Steven van Rijswijk told analysts at the investor day: “I've done that [split responsibility for the roles] to be able to focus on the one hand on digital delivery; on the other hand on our scalable operations.

Handing over to the COO and the CTO, he added: “The second decision we've taken is that we have refocused our investments in digital – so not so much anymore on these multi-country business integrations, but much more to where we can make a difference for our customer: so investing in our processes, end-to-end digital."

(Perhaps startlingly to some, van Kemenade was ING's first ever CTO -- appointed to the position in 2021 he was previously CIO. With the change in titles he was also handed a seat on the bank's management board.)

ING private cloud: "More economical than public cloud"

The ING CTO offered little detail on the bank's private cloud setup ("a highly converged, highly concentrated and fully standardised infrastructure") -- a quick snoop by The Stack suggests some heavy investment in VMware -- beyond noting that "the ING Private Cloud reduces our operating expenses... by €100 million."

The Dutch multinational said it runs 30% of its global infrastructure on IPC in December 2021, with Wouter Meijs, then-Global Head of Cloud, ING adding in 2021: "No matter how big the company, a private cloud will never be able to match the scalability, stability, and ease of use of Azure, GCP and AWS. But all of this comes at a cost.

"For the standard 24x7x365 workloads" he wrote, "we found that a private cloud is more more economical than the public cloud. But more importantly, while public cloud offers a large number of different options and configurations, it is restrictive in the services offered and some of the more traditional applications will require quite some effort to make them ready to run on public cloud. Here as a private cloud can help as the flexibility to offer specialised services (although potentially at a lower level of automation) is much higher..."

The ING CTO added today: "We have broken up our end to end customer journeys in smaller pieces. So where applicable, we do implement the modules that are common, and we can cater for local differentiation in markets where that needs to be. And thirdly, which is an important element, it's fully self-service, we have productised all of those services and capabilities in such a way that engineers and ops people can easily make use of them, without somebody to support them. So we have taken out the middleman: it's highly digital and automated, otherwise, it wouldn't scale."

In terms of other IT/technological focuses at the bank, COO/CTO van Stiphout suggested the shift away from those failed "multi-country business integrations" at the bank alluded to by the CEO had been a painful one.

He said: “We've learned a great deal over the last couple of years… things that have gone well, and things that have gone not so well. I think previously, we were going across all these markets trying to put in identical ‘houses’, irrespective of the commercial and regulatory environments, etc. It didn't really work for us; that didn't really go well enough… We have moved on through these learnings and become more practical. The commercials are different, the regulatory environment is different [in each market], so let's make sure we adapt our ‘house’.“

"[Now] Ron and I, we use the same materials, use the same process, the same plumbing, and we put the same energy label on it… we have proven pieces that we are reusing and leveraging; we still invest in scalable technology operations, but we're absorbing largely the cost of inflation and the cost of volume growth.”

Join peers following The Stack on LinkedIn

The current focus meanwhle is a threefold one, the two suggested: 1) Making growing use of reusable services and components; 2) further, deeper deployment of ING’s homegrown “Touchpoint” middleware platform and 3) consolidation of application hosting on a private cloud environment with some public cloud integrations.

Referring to Touchpoint, ING CTO Ron van Kemenade told investors that “I'm actually quite proud of it; it's quite unique for a bank to build such an extensive in-depth technology platform… it reduces our cost to serve.”

The API-centric layer of middleware was put in place in part because ING local branches often rely on their own IT systems, meaning that "guaranteeing a unified user experience to all customers and on all digital devices can be quite a challenge" as one participant in the build has put it, noting that "the need for a state-of-the-art, unified platform became even more pressing, especially with the introduction of the PSDII directive, requiring banks to make their system accessible to third parties". (The Touchpoint Architecture Platform or TPA uses an API Gateway for 'external' client applications to access the TPA platform API's. It’s “target state” is that all APIs within ING across all countries can communicate with each other with little restrictions within the platform” as one recent architect job posting reveals… Software engineering community Flock has been involved in that project and in a short blog notes that as part of its build, “we visited ING’s foreign branches and tried to win individual developers over to switching from their trusted technologies (Vue, Angular, Full React) to the unified Touchpoint based on Web Components.”)