It has long been known that flooding is the most costly natural disaster in terms of financial losses, writes Dr Christopher Sampson, co-founder and director at flood risk intelligence company Fathom. Although different countries face floods of varying type and severity, the wider implications remain the same. With the exception of certain types of agriculture that rely upon seasonal flooding, any flood that coincides with human activity is a disaster for those affected, and these disasters are a major driver of financial and physical loss.

The Climate and Catastrophe Insight Report, published in 2020, identified $2 trillion worth of damages caused by flooding globally since 1950. This figure likely understates the total impact, because losses caused by flooding during tropical cyclone events are usually categorised as tropical cyclone losses rather than flood losses. This means that costly events, such as Hurricane Katrina or Hurricane Harvey, may not appear in many flood loss statistics, even when the majority of losses accrued during these events were driven by flooding.

Data availability, rapid algorithms, and greater availability of computer power means no patch of land globally is without a flood model.

Furthermore, the losses accumulated as a consequence of flooding extend much further than financial. In 2020, 5 of the 6 deadliest events were seasonal floods (India, Pakistan, Nepal, China and Bangladesh). In West Bengal alone, 239 people died as a result of floods and landslides during the 2020 monsoon season. The social consequences extend far beyond this. Immediate impacts include loss of crops and livestock; the devastation of transport routes and infrastructure; and mass displacement forcing entire communities to leave their homes. Flooding is, therefore, a critical consideration for physical asset management and supply chain risk.

Why do decision-makers typically overlook flood risk?

Historically, decision-makers have often overlooked flooding and the risk it poses. This is mainly due to the enormous challenge of mapping asset-scale flood hazard at a national scale, leading to a lack of readily available information to planners and developers in many territories. Although some countries, such as the UK and Japan, have good national coverage, many may be surprised to learn that much of Western Europe, North America and Australia have only partial coverage, while much of the rest of the world has none at all.

Therefore, even when focusing on areas that one might expect to be well modelled, such as the US, we typically find limited public coverage. From Fathom’s own research and modelling work, estimates suggest that ~3x as many people may be exposed to the 100-year flood as highlighted in FEMA’s predicted 100-year flood zones. This is not because FEMA’s zones are necessarily incorrect; they are simply incomplete. By relying solely on these datasets, institutions and individuals alike are not able to build resilience against flooding such as through financial mitigation (e.g., insurance) and/or physical mitigation (e.g., flood defences).

The key piece is globally-seamless terrain data, collected by satellites and painstakingly corrected by the scientific community

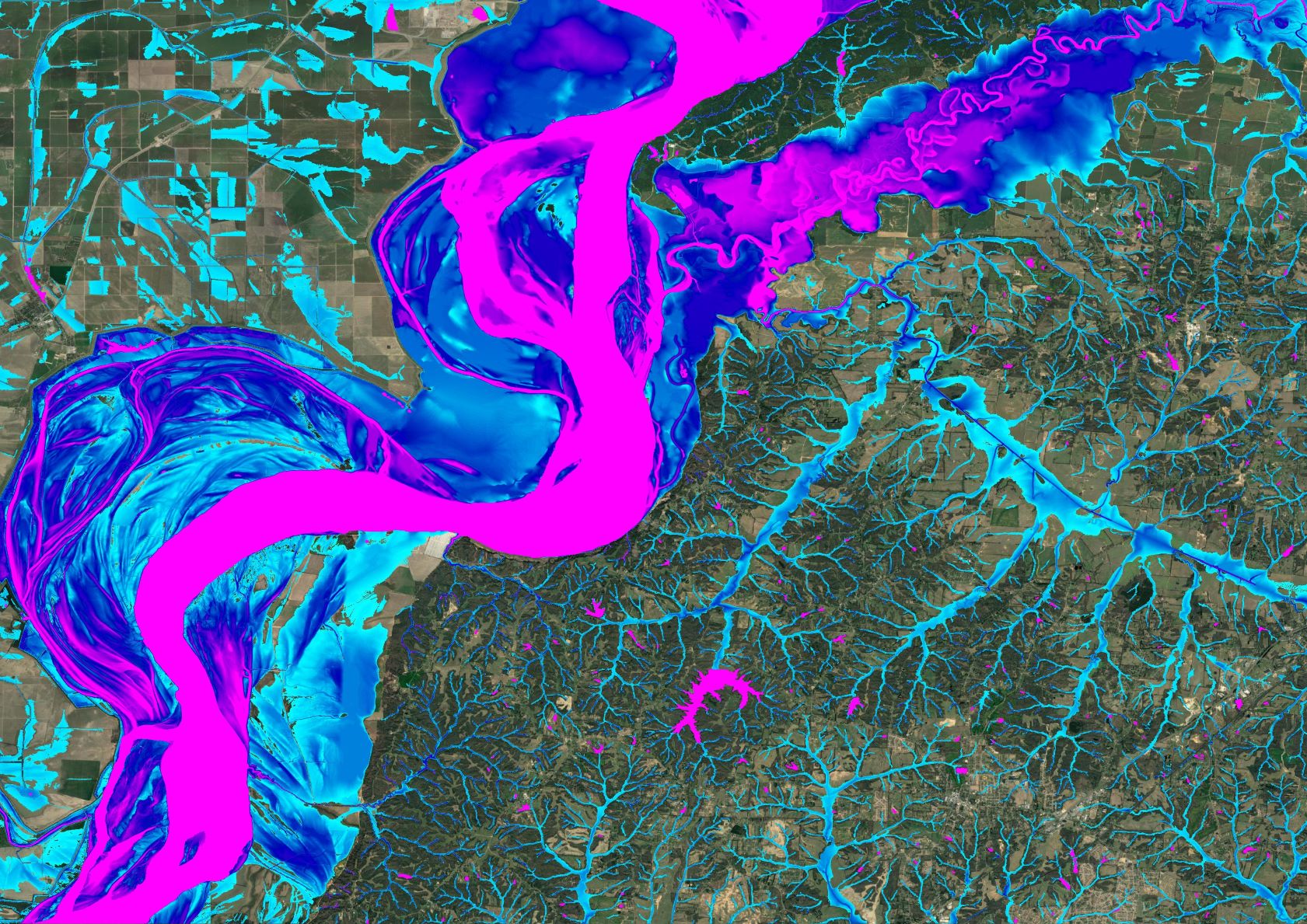

As an organisation, we have started to fill in some of these missing gaps. Our global flood model predicts flood risk at a 90-metre resolution for over 220 countries around the the world. This means that regions traditionally considered ‘data-scarce’ now have some information on their flood risk available.

To model flood risk accurately at this scale is an enormous endeavour, requiring a suite of technological tools which are the culmination of decades of collaborative work by scientists all over the world. The key piece is globally-seamless terrain data, collected by satellites and painstakingly corrected by the scientific community. Alongside channel and defence detection algorithms that we have helped to build, all the major data requirements of a global flood model have fallen into place. Marrying data availability, rapid algorithms, and greater availability of computer power means no patch of land globally is without a flood model.

See also: Goldman Sachs to add carbon accounting to investment app

Through our work in areas such as the US, we can already begin to see how democratising availability of the crucial information – through the public release of our flood data – is allowing individuals and organisations to build resilience to this growing problem.

However, the lack of complete national datasets is a result of the challenges of modelling floods at national scales. The movement of water across the landscape is driven by gravity, which means that terrain exerts a strong control over which areas flood. Because elevation can change over short distances, flood models have to operate at relatively high spatial resolutions if they are to be useful for individual properties or other physical assets. Add to this the numerous other complexities that govern flooding (such as engineered flood defences or understanding exactly how much water might be flowing downstream during a flood event), and it becomes clear why scientists and modellers are only now beginning to be able to simulate this complex phenomenon across very large areas at high resolution.

On a developmental level, human societies also have a surprisingly short ‘memory’ of major floods. Studies suggest that the experience of a major flood may prevent floodplain development for about 25 years following the event, but after this, new settlements begin to get closer to the watercourse again. This flood ‘amnesia’ demonstrates that historical memory is not enough to protect communities.

Paired alongside a lack of flood-risk data, we have seen little resistance to poor planning decisions, resulting in the widespread development in floodplains.

How the tide is changing and why demand is creating new dangers

Looking to the future, we believe the problem of flood risk is going to get worse.

The climate change angle is nuanced, due to uncertainties in how governments and societies will respond over the coming years (‘scenario uncertainty’) and uncertainties in our modelling approaches. In general, a warmer atmosphere can hold more moisture and extreme rainfall will become more frequent. However, there will be other places where the opposite is true. Our own modelling indicates, for example, that in the UK, central and western areas will see more increases in flood risk than eastern areas. The US, the Gulf Coast and Eastern Seaboard will suffer the greatest increases; whilst central areas may experience a decline in flooding.

Apply now for The Stack's #techforgood Awards: Nominations close April 30.

The urbanisation and development angle is more certain. All studies and modelling that we are aware of, or that we have performed ourselves, indicate that exposure is going to increase due to continued development (and asset wealth accumulation) on floodplains. Investors may be particularly interested in newly emerging exposure hotspots in areas that are currently both undeveloped and beyond the reach of floodwaters, but in the future will be both developed and at risk of flooding due to the combined effects of climate change and continued urbanisation. Detailed, high resolution models of both flood hazard and urbanisation are required to tease out such areas, but models suggest they could be significant.

How can we combat these dangers?

As climate risk increases, and in turn assets are exposed to higher risk, we are beginning to see the financial market wake up to the risk of flooding. Pressure from legal institutions such as the United Nations, European Union and Prudential Regulatory Authority has driven banks and insurers to incorporate climate-related financial risk into their governance processes.

This demand has caused the emergence of for-profit climate analytics firms with climate models claiming to accurately quantify financial loss. Yet the impact of climate change on flooding is extremely difficult to quantify precisely. We can make broad assertions about the direction of change with some degree of confidence, but anything local is effectively impossible to model with the current tools climate scientists are working with.

Climate models cannot yet offer predictions for location-specific, low-frequency events with enough certainty for investors

Climate models are able to simulate long-term global averages across large areas well; unfortunately the types of individual extreme weather events that cause flooding constitute the exact opposite of this. For example, for an individual, a tropical cyclone represents an awe inspiring demonstration of nature's capacity for destruction, but to a climate model they are small, outlying events that are too small to properly represent within the model’s relatively-coarse three dimensional grid. Climate models therefore cannot yet offer predictions for location-specific, low frequency events with enough certainty for investors to make investment decisions without the potential for unintended consequences. Until the time comes when climate models can better capture such physical phenomena, the modelling industry must balance scientific integrity and market demand.

The use of climate models in the financial sector in particular must therefore be cautious and nuanced, ensuring that end-users are fully briefed on the uncertainties and have the capabilities to consume the data appropriately.